The price of Bitcoin surged above $58,700K as the BlackRock Bitcoin ETF experienced a significant influx of $520 million. This influx came from a net inflow totaling $577 million.

Spot Bitcoin ETFs are having a stellar week, with a $520 million inflow on Monday followed by another robust inflow of $577 million on Tuesday. The significant influx was primarily driven by the BlackRock iShares Bitcoin ETF, which alone saw an inflow of $520 million. These developments signal strong potential for a Bitcoin price rally to $60,000.

Record Inflows for Spot Bitcoin ETFs

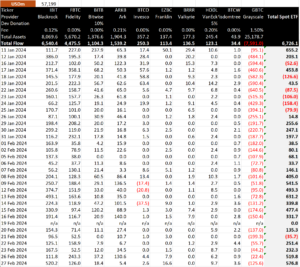

According to data from BitMEX Research, spot Bitcoin exchange-traded funds (ETFs) saw a significant net inflow of $577 million, or 10,167.5 BTC, on February 27. This marked the third-largest inflow ever recorded, with all nine spot Bitcoin ETFs experiencing substantial trading volumes. However, Grayscale’s GBTC witnessed increased outflows on Tuesday, reaching $125.6 million after a brief drop to $22.4 million the previous day.

The BlackRock iShares Bitcoin ETF (IBIT) saw a remarkable inflow of over $520 million, setting a new record for the largest inflow to date. IBIT also achieved a record daily trading volume of $1.3 billion, surpassing the trading volume of many large-cap US stocks. With this latest influx, BlackRock’s net inflow surged to over $6.5 billion, with asset holdings exceeding 141,000 BTC.

Other spot Bitcoin ETFs, including Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF, saw inflows of $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and various other spot Bitcoin ETFs also experienced substantial inflows, indicating strong bullish sentiment among both retail and institutional investors.

Despite the outflows from GBTC, Bloomberg senior ETF analyst Eric Balchunas noted that the daily trading volume of the nine new spot Bitcoin ETFs, excluding GBTC, surpassed $2 billion for the second consecutive day. This trend coincides with Bitcoin’s price holding firmly above $57,000, showcasing continued strength in the cryptocurrency market.

Source: BitMEX Research

Crypto Market Reaches Extreme Greed as BTC Approaches All-Time Highs

The Crypto Fear & Greed Index has surged to a four-year high of 82, signaling that the market sentiment is currently in the ‘Extreme Greed’ zone. This heightened level of FOMO (Fear of Missing Out) has extended beyond the crypto sphere, reaching Wall Street as traders show exceptional interest in Bitcoin.

Experts have anticipated that Bitcoin’s price could reach $60,000 before the upcoming bitcoin halving event. With BTC currently trading at $59,000, it sits less than 15% away from its all-time high of $68.6K established 27 months ago.

Good morning,#Bitcoin is above $58K, where funding rates are going through the roof.

Astonishing strength, definitely areas to start looking for profits. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

In the last 24 hours, Bitcoin’s price experienced a low of $56,219 and a high of $59,000. Moreover, there has been a slight increase in trading volume, indicating ongoing interest and activity among traders in the market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News