In Q1 2024, Coinbase disclosed a total revenue of $1.64 billion, accompanied by a net income of $1.18 billion. Consumer transaction revenue amounted to $935 million, while subscription and service revenue contributed $511 million.

Coinbase, the leading digital asset trading platform in the United States based on trading volume, announced a net income of $1.18 billion, equivalent to $4.40 per share. This marks a significant improvement compared to the previous year’s loss of $78.9 million, or 34 cents per share.

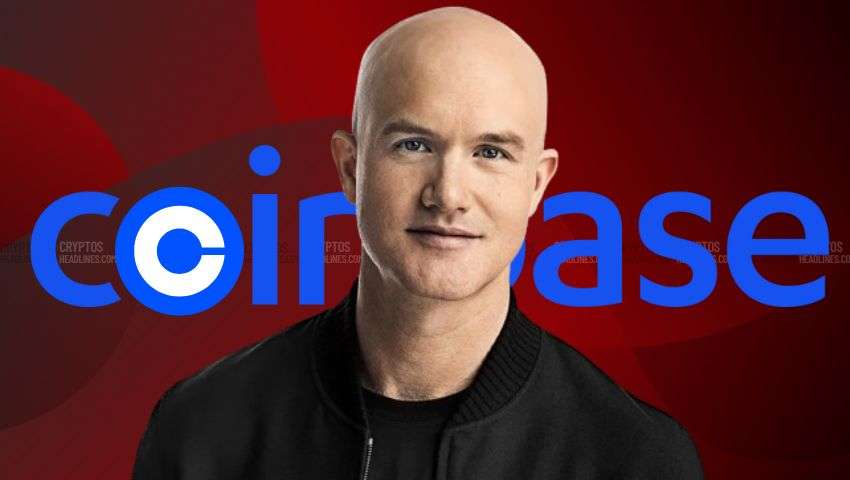

Coinbase Reports First Profit in Two Years

In February, Coinbase achieved its first profit in two years, coinciding with the surge in Bitcoin (BTC) prices. This notable increase in net income was partly attributed to a $650 million mark-to-market gain on crypto assets held for investment. This gain followed the adoption of updated accounting standards by the company.

Coinbase witnessed a significant surge in revenue across various categories. Consumer transaction revenue notably reached $935 million for the quarter, more than doubling from the same period last year. Total transaction revenue nearly tripled to $1.08 billion, with subscription and services revenue contributing $511 million for the quarter.

Investors responded positively to the news, with Coinbase shares climbing almost 9% on Thursday ahead of the report. Year-to-date, the stock has risen approximately 32%, building on a nearly fivefold increase in 2023.

Crypto Market Milestones in Q1 2024

Bitcoin and Ethereum Milestones: During the first quarter of 2024, the crypto market witnessed significant milestones. Bitcoin soared to an all-time high above $73,000 in March, marking a remarkable achievement for the leading digital asset. Meanwhile, Ethereum, the second-largest digital asset, underwent its first major upgrade in over a year, signaling developments in the blockchain ecosystem.

Institutional Investment Surge: The approval of new US spot bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) further fueled institutional interest in cryptocurrencies. Many institutional investors partnered with Coinbase as their custody partner, attracted by the credibility and security of the platform. Collectively, these funds brought in more than $50 billion by the end of the first quarter, highlighting the growing institutional adoption of digital assets.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News