The SEC caught Coinme, a company that operates crypto ATMs and exchanges, for breaking the law by selling a cryptocurrency token and making false statements about it.

Coinme, a crypto exchange, has been fined almost $4 million by the US securities regulator for selling unregistered securities and making false statements about its crypto token UpToken (UP).

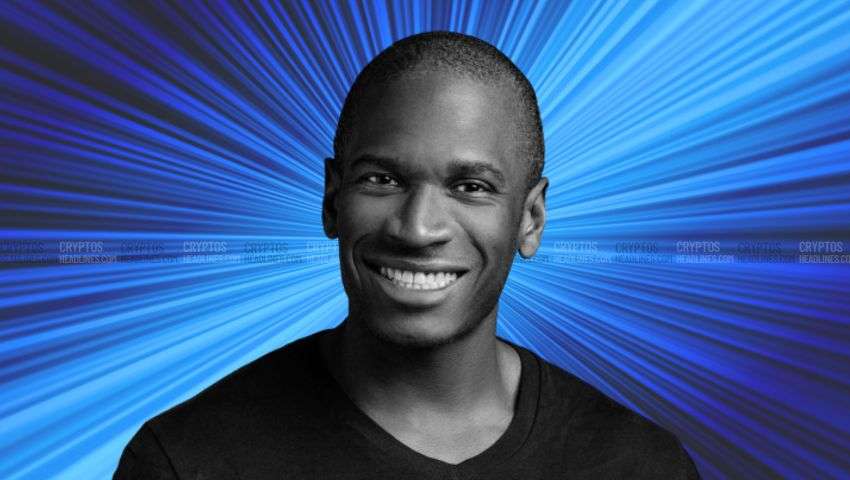

The SEC resolved accusations against Coinme, a subsidiary called Up Global SEZC, and their CEO Neil Bergquist on April 28th.

Up Global agreed to pay a penalty of $3.52 million, which Coinme is also responsible for paying. Coinme and its CEO, Neil Bergquist, were fined $250,000 and $150,000 respectively, and have agreed to pay those penalties.

According to the SEC, Coinme, Up Global, and Bergquist’s ICO of UP from October to December 2017 was an investment contract that qualifies as a security under the Howey test, and therefore should have been registered before being offered to investors.

The September 2017 press release announcing UpToken. Source: GlobeNewswire

The ICO raised approximately $3.6 million to increase the number of Bitcoin ATMs in Coinme’s fleet. With the ICO funds, Coinme added 30 ATMs. People who owned UP received advantages such as lower fees and a 1% cashback paid in UP when they used the ATMs.

Coinme raised about $3.6 million through the ICO to expand its Bitcoin ATM fleet. They used the funds to add 30 ATMs to their network. People who owned UP tokens got benefits like reduced fees and 1% cashback paid in UP when they used the ATMs.

Coinme got $3.6 million from the ICO to grow its Bitcoin ATMs. They spent the money to add 30 more ATMs. People who owned UP tokens got rewards like lower fees and 1% cashback in UP when they used the ATMs.

Since then, the value of UP has dropped significantly, and its market capitalization has decreased to about $50,000. In the last 24 hours, trading volumes have only reached just over $180.

The price of UpToken from early 2018 to today. Source: CoinMarketCap

The SEC also accused Bergquist and Up Global of making untrue and deceptive claims about the popularity of UpToken and the sum raised in the offering.

Up Global stated that Coinme’s use of UP to finance its ATM rewards scheme would generate ongoing demand for the token. However, the SEC disagreed, saying:

The SEC claimed that Bergquist and Up Global made arrangements before and during the ICO to obtain a large amount of UpToken, which would significantly decrease the amount of UpToken that Coinme would have to purchase after the ICO for the ATM rewards program.

The SEC alleged that Coinme transferred 160 BTC valued over $1 million at the time to an Up Global wallet used to receive investment funds in the ICO. Up Global returned roughly 14.5 million UP to Coinme at a reduced rate, and the transaction gave the impression that a third party had made a large purchase, which the SEC claims was done knowingly or recklessly.

The SEC also alleged that Bergquist arranged a deal with a Hong Kong firm involving a 500 Bitcoin transaction of UP tokens, with Coinme borrowing the money to buy more UP at a lower rate. This transaction was allegedly utilized to make it seem like there was a high demand for the tokens.

The SEC stated that Bergquist neither accepted nor refused the findings of the regulatory body but agreed to resolve the accusations and was prohibited from serving as an executive of a public company for three years.