Crypto experts say investors are moving away from big exchanges like Binance and Coinbase and instead staking their ETH on decentralized options due to regulatory worries and the potential for bigger rewards.

Blockchain data indicates that since the Shanghai upgrade of Ethereum, centralized crypto exchange giants Binance and Coinbase have experienced large outflows of staked ether (ETH) as investors turn to decentralized alternatives.

Since April 12, Coinbase’s staking platform has seen investors withdrawing more ETH than depositing, causing a net outflow of $367 million in staked ETH. Binance, the largest crypto exchange in the world, also experienced a net outflow of $340 million in staked ETH on its staking service.

Instead of centralized exchanges, decentralized liquid staking protocols are gaining popularity among investors, with Frax Finance and Rocket Pool recording large net inflows of $56 million and $68 million, respectively.

After Ethereum’s Shanghai upgrade on April 12, investors were able to withdraw around $35 billion of tokens that were previously locked up in staking contracts. Analysts believed that this would be a significant step for the $225 billion network, potentially increasing staking participation, attracting institutional investors, and rearranging the competition between staking services. As a result, investors have shifted to decentralized liquid staking protocols, leading to large outflows of staked ether from centralized exchange giants such as Coinbase and Binance. Meanwhile, decentralized platforms such as Frax Finance and Rocket Pool have experienced significant net inflows.

According to Ahmed Ismail, founder and CEO of liquidity aggregator platform FLUID Finance, the Shanghai upgrade has significantly encouraged the use of decentralized liquid staking solutions.

Liquid staking protocols create a type of digital token that shows how much cryptocurrency is locked up, and this token allows investors to use decentralized financial services like lending and borrowing.

Frax and Rocket Pool have received more deposits, causing the amount of ETH staked on both platforms to increase by 32.5% and 31% in the last 30 days, respectively. DefiLlama provided this information.

Lido Finance, which is the biggest decentralized liquid staking protocol with around $11 billion of deposits, has received around $28 million (15,208 ETH) more deposits than withdrawals since April 12.

Regulatory concerns, higher yields

Investors are likely turning to decentralized staking protocols due to regulatory concerns and the fear of centralized crypto platforms after some bankruptcies last year, according to Tom Wan, an analyst at digital asset investment firm 21Shares.

In February, the SEC charged Kraken for offering unregistered securities and the exchange agreed to close its staking service. Following this, decentralized liquid staking protocols became more popular as investors began to view centralized staking services as more risky.

John “Omakase” Lo, who is the head of digital assets at investment firm Recharge Capital, thinks that centralized entities might continue to face regulatory pressure.

“The uncertainty isn’t good for retaining deposits,” he added.

Investors may be attracted to decentralized protocols due to the higher staking rewards they offer. While centralized platforms like Coinbase and Binance offer around 4% annual reward for staking ETH, decentralized protocols like Lido Finance and Frax Finance offer higher rates of 5-7%.

“Centralized liquid staking typically offers lower yields due to compliance and staffing costs,” explained Omakase.

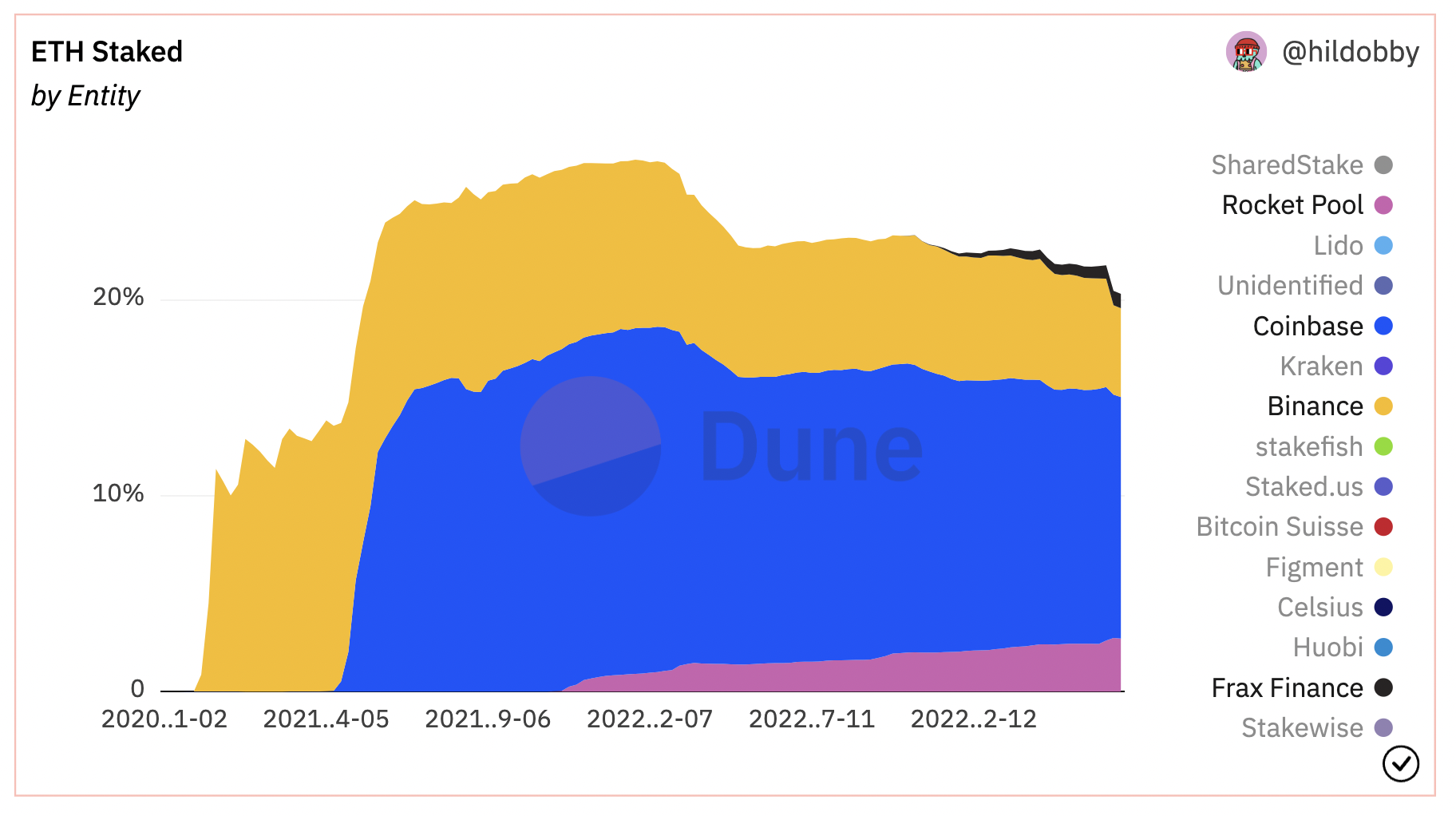

Even though many investors are moving their ETH holdings to decentralized alternatives, Binance and Coinbase are still some of the biggest providers of ETH staking services. However, Binance’s market share has fallen from 5.7% to 4.5% in the past month, and Coinbase’s market share has dropped from 13% to 12.3%.

According to data from blockchain intelligence firm Nansen, Coinbase and Binance are likely to face more outflows. As per the data, Coinbase has around $191 million worth of staked ETH that is yet to be withdrawn, while Binance has $41 million in withdrawal requests pending.