Dogecoin did not perform well in this cycle, as indicated by its current state. At the current price, 83% of DOGE holders are profitable. The price of Dogecoin is largely influenced by broader market trends.

Dogecoin (DOGE) has shown mixed performance in the recent cycle. About a week ago, it experienced minor gains fueled by excitement over the spot Ethereum ETF, seeing an 8% increase in a single day. However, as of the latest update, its charts indicate a downward trend.

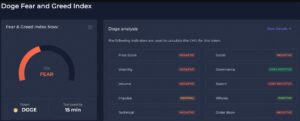

Dogecoin Market Insights

According to IntoTheBlock data, the majority of Dogecoin (DOGE) holders, about 83%, are currently profitable at the current price. This indicates a favorable position for long-term investors, despite recent market losses. Additionally, a significant portion of Dogecoin’s total supply, approximately 63%, is held by large holders known as whales. This concentration of ownership among whales can influence market dynamics and price movements.

Dogecoin exhibits a strong correlation of 0.86 with Bitcoin, suggesting that its price movements are heavily influenced by broader market trends, particularly those of Bitcoin. This correlation underscores Dogecoin’s sensitivity to developments in the overall cryptocurrency market.

Recent exchange data reveals nearly balanced activity for Dogecoin, with approximately $221.14 million in inflows and $221.68 million in outflows recorded last week. This equilibrium suggests a steady state of buying and selling among investors, with neither bullish nor bearish sentiment clearly dominating the market charts.

Dogecoin’s Market Dynamics and Performance Analysis

Dogecoin (DOGE) has exhibited a notable pattern where sudden spikes in short liquidations coincide with rapid price increases. This suggests that quick uptrends often force short sellers to close their positions at a loss, contributing to volatile price movements. The overall trend shows a mix of both long and short liquidations without a clear dominance, indicating a market driven by speculative trading and abrupt price changes rather than sustained directional movements.

This liquidation pattern mirrors DOGE’s broader price performance, characterized by resilience amid short-term rallies and corrections. Typical of meme tokens, Dogecoin’s monthly chart reveals a landscape marked by volatility and market sentiment fluctuations. Over the past month, DOGE has primarily fluctuated within a narrow price range of approximately $0.135 to $0.175, reflecting its ongoing struggle with market volatility and speculative trading activity.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News