Big investors are getting into trusts linked to Ethereum (ETH) a bunch. They seem to really like ETH 2.0, thinking it shows the project is going to do well for a long time.

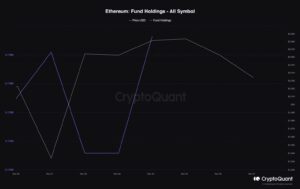

More money has been going into Ethereum (ETH) trusts and ETFs since November 23. Currently, according to CryptoQuant, the Ethereum Funds Holdings have gone up to 3.17 million. This rise in numbers shows that big institutions are really interested in investing in this altcoin.

Source: CryptQuant

Growing Institutional Interest in Ethereum (ETH)

Woominkyu, a verified author on CryptoQuant, recently delved into the market sentiment surrounding Ethereum (ETH). Going beyond a general examination, Woominkyu specifically analyzed the impact of increased inflow on ETH’s price action.

The surge in investments coincided with Ethereum’s price stabilizing between 1.8K and 1.9K USD. Woominkyu interpreted this as a clear indication of mounting interest from institutional investors. It reflects their strong confidence in Ethereum’s long-term value and the potential for market growth.

This bullish sentiment is not only attributed to price stability but also linked to optimism regarding a potential spot ETF approval. Additionally, there are other contributing factors, including significant changes Ethereum has undergone over the past year.

Chief among these is Ethereum’s transition to Proof-of-Stake (PoS), known as the Merge. Consensys, in a blog post last year, foresaw the potential impact of the Merge on institutional inflow. Enhanced security is one such impact, providing institutional investors with increased confidence in the protocol’s ability to safeguard their funds.

Another crucial factor discussed is the deflationary supply. The reduction in supply makes ETH a more attractive asset for institutions, as it may lead to an increase in value. This positive outlook stems from the Ethereum-powered software company’s observation that a deflationary supply reduces the risk of ETH devaluing to zero.

Ethereum’s Confidence Boost

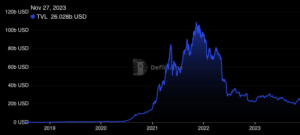

The activation of the Shapella upgrade in April played a pivotal role in bolstering the confidence of significant investors in Ethereum. The Total Value Locked (TVL) of Ethereum further reinforced the idea that more participants now trust the blockchain compared to 2022, reaching $26.02 billion at present.

Source: DefiLlama

Notably, the TVL has seen a substantial 19.31% increase in the last 30 days. If this trend continues, both retail and institutional investors are likely to consider buying Ethereum for potential long-term gains.

A detailed examination of the Long-Term Holder Net Unrealized Profit and Loss (LTH-NUPL) reveals a shift in market sentiment from hope (orange) to optimism (yellow). Acting as an indicator for assessing the behavior of long-term holders, this change signifies that holders of Ethereum are no longer fearful. Instead, most now hold the belief that ETH holds significant future potential.

Source: Glassnode

Looking ahead, if the price of ETH surpasses $2,000 in the coming weeks, the LTH-NUPL is expected to transition to the belief stage. At this juncture, a considerable accumulation may take place, potentially triggering an extended rally for Ethereum.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News