Ex-CFTC Chairman: Crypto Needs New Trading Structure to Survive.

Massad: Money Laundering Dominates 50-90% of Crypto Transactions.

Massad and Fed Chair Call for Immediate Investor Protection Measures.

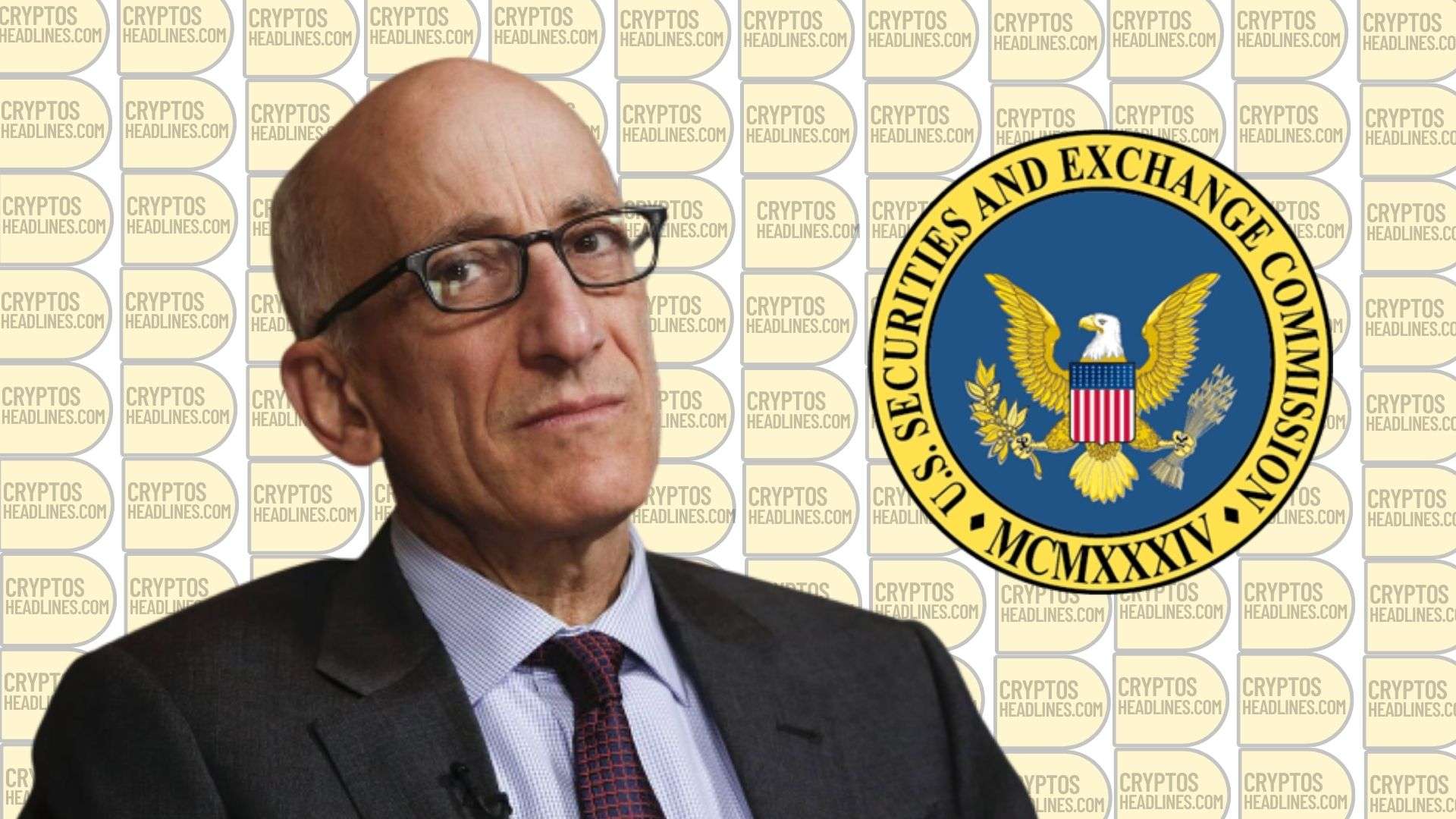

In an interview with CNBC, Timothy Massad, former chairman of the US Commodities Futures Trading Commission (CFTC), highlighted that the government’s ongoing legal actions against cryptocurrency exchanges Binance and Coinbase will play a significant role in shaping the future trajectory of cryptocurrencies.

Massad emphasized the need for the government and the Securities and Exchange Commission (SEC) to establish a new industry structure that prioritizes investor protection, prevents fraud and manipulation, and resolves the question of whether digital tokens should be considered securities.

While acknowledging the fascinating technology behind cryptocurrencies, Massad pointed out that practical use cases connecting to the real economy are currently limited. He stressed the importance of creating a regulatory framework that fosters innovation while ensuring investor safeguards, allowing for the potential emergence of valuable developments in the field.

Massad highlighted wash trading as one of the major concerns in the cryptocurrency industry, where individuals or affiliates engage in deceptive trading practices to mislead others about the performance of stocks. He stated that this form of fraud constitutes a significant portion, ranging from 50% to 90%, of cryptocurrency transactions.

Also Read This Related: SEC’s Strength to be Reinforced if Lawsuit Against Binance and Coinbase Succeeds

Massad further mentioned that he, along with Federal Reserve Chair Jay Powell, has been advocating for immediate measures to protect investors while the government focuses on constructing a comprehensive new framework model.

The US Securities and Exchange Commission (SEC) has taken legal action against Binance, the largest cryptocurrency exchange globally, and its founder Changpeng Zhao. The SEC alleges that Binance commingled substantial amounts of customer funds and transferred them to a European company owned by Zhao.

In a separate case, the SEC has filed a complaint against Coinbase, a New York-based cryptocurrency exchange, accusing it of promoting unregistered securities.

According to the complaint, the US Securities and Exchange Commission (SEC) asserts that Coinbase has been functioning as an unlicensed securities broker since 2019, which is approximately two years prior to its initial public offering (IPO) in April 2021. The SEC’s complaint raises concerns about Coinbase’s alleged operation without the required licensing during that period.

The US Securities and Exchange Commission (SEC) argues that Coinbase’s staking program, which involves five different crypto assets, qualifies as an investment contract and therefore falls under the category of a security. While Kraken had previously settled with the SEC and ceased its staking services in the US, Coinbase has been engaged in a dispute with the SEC regarding its staking products, maintaining that they do not meet the criteria to be classified as securities.

Industry analysts suggest that the recent regulatory actions taken by the US Securities and Exchange Commission (SEC) against Coinbase in the US and Binance in the Cayman Islands could potentially benefit firms operating in the US in the long run by offering legal clarity. However, in the short to medium term, these proceedings may prompt these companies to shift their focus to other regions or markets as they navigate the regulatory landscape.

Also Read This Related: US SEC’s Recent Actions Could Have Severe Consequences, Cautions Hong Kong Lawyer

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines On Google News:

Join Cryptos Headlines Community: https://linktr.ee/cryptosheadlines.com