Grayscale is launching a smaller Bitcoin ETF that’s way cheaper than the current one, almost ten times less expensive. But Eric Balchunas, a Bloomberg analyst, says it’s too early to celebrate.

Grayscale claims their new “mini” version of the Bitcoin Trust ETF will have fees nearly one-tenth of what they charge now, making it the most affordable among the spot Bitcoin ETFs that are allowed.

Grayscale’s Bitcoin Mini ETF Fees: A Cautionary Tale

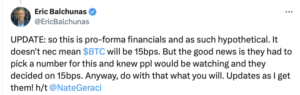

Bloomberg analyst Eric Balchunas advises investors not to jump the gun just yet. He points out that the fees announced by Grayscale for their upcoming Grayscale Bitcoin Mini Trust (BTC) are preliminary and subject to change before the launch. Balchunas stresses that these fees are currently based on pro-forma financials and should be considered hypothetical at this stage.

In a post on April 20, Balchunas highlighted the significance of the chosen fee of 15 basis points (bps), stating that Grayscale likely aimed to attract investor attention with this figure. While acknowledging the attention-grabbing nature of the proposed fees, he emphasizes the speculative nature of these figures until the ETF is officially launched.

Source: Eric Balchunas

Grayscale’s proposal entails setting the fees for the Grayscale Bitcoin Mini Trust (BTC) at one-tenth of the current 1.5% fee for their flagship Grayscale Bitcoin Trust (GBTC). This move, outlined in a recent filing with the United States Securities and Exchange Commission (SEC), aims to position the new ETF as a more cost-effective option for investors. However, Balchunas warns against premature excitement, reminding stakeholders to remain cautious until the details are finalized closer to the ETF’s launch.