Cryptocurrency users affected by FTX’s bankruptcy shared their worries on social media, asking FTX to take responsibility. FTX has opened a claim window, but the prices offered for major crypto assets like Bitcoin (BTC), Ethereum, Solana (SOL), and BNB were much lower than their actual values.

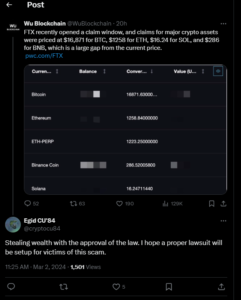

According to Wu Blockchain’s research, the prices set by FTX for claims are $16,871 for BTC, $1,258 for ETH, $16.24 for SOL, and $286 for BNB. These numbers are significantly lower than the current market rates, which are $62,144 for BTC, $3,424.62 for ETH, $129.96 for SOL, and $411.32 for BNB.

FTX Bankruptcy Sparks Concerns and Official Response

Cryptocurrency users affected by FTX’s bankruptcy have voiced concerns about the pricing disparity on the platform, questioning its fairness and transparency. Many have taken to social media to express their worries, seeking accountability from FTX.

A screenshot of Claim Window Pricing – Source: cryptocu84

In response to the criticism, PwC issued an official statement on its website, providing insights into the situation surrounding FTX. PwC disclosed that FTX Digital Markets Ltd. is undergoing a Chapter 11 settlement with FTX Trading Ltd. and its affiliated debtors, aiming to combine assets from both entities’ estates.

FTX’s official liquidator has notified creditors to submit electronic claims by May 15, 2024. The PwC-managed claims portal is expected to make its first interim distribution in late 2024 or early 2025, with all eligible claims denominated in United States dollars.

Recently, FTX issued a cautionary statement regarding its authorized investment manager. FTX noted that certain unauthorized third parties have begun attempting to bid on behalf of specific FTX Debtors, prompting the firm to take preemptive measures.

FTX’s Monthly Stakeholder Communication: Key Updates

In its first monthly communication to stakeholders, FTX utilized the X platform to notify creditors about the sale of Digital Assets by FTX Debtors, as mandated by a bankruptcy court order. The exclusive jurisdiction for this process falls under Galaxy Asset Management, the court-appointed investment manager.

FTX emphasized that only Galaxy Asset Management is authorized to handle any selling offers or buying requests. The bankrupt exchange advised interested parties, especially institutional buyers and those complying with regulations, to adhere to this guidance.

Furthermore, FTX secured approval from the United States Bankruptcy Court for the District of Delaware during a Feb. 22 hearing to sell its stake of over $1 billion in the artificial intelligence (AI) firm Anthropic.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News