Leaders from the world’s 20 biggest economies are taking steps to put in place a system for tracking cryptocurrency activities globally.

This framework, called the Crypto Asset Reporting Framework, is designed to ensure that crypto transactions and the people involved in them are more transparent to tax authorities. It involves sharing information between different countries, even for transactions on unregulated crypto platforms and with digital wallet providers.

In addition to this, the group also supported the recommendations from the Financial Stability Board about how to regulate global stablecoins, which are cryptocurrencies designed to have a stable value. These measures are part of an effort to better regulate and monitor the cryptocurrency space on a global scale.

Timeline for Legal Framework Established

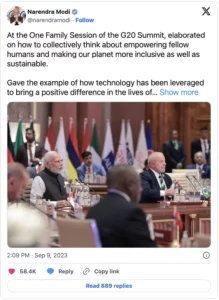

During a two-day summit in New Delhi attended by leaders from various countries, an agreement was reached to implement a legal framework for the exchange of information related to crypto assets.

This framework, known as the Crypto Asset Reporting Framework, is set to become operational in 2027.

The leaders from G20 countries signed a consensus statement, urging the swift implementation of this framework and changes to the Common Reporting Standard (CRS). They called on relevant jurisdictions to establish a coordinated timeline for initiating information exchanges through the Global Forum on Transparency and Exchange of Information for Tax Purposes.

The adoption of this framework will impact numerous countries, including Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, the United States, and the European Union.

Project Scope

The Crypto Asset Reporting Framework, introduced by the OECD in October 2022, aims to provide tax authorities with better insight into cryptocurrency transactions and the people involved. Under this framework, countries will automatically share information about crypto transactions across borders, including those conducted on unregulated crypto platforms and through wallet providers.

Many countries are already implementing tracking standards for crypto transactions, with the European Union recently approving updated rules that require the inclusion of user details like usernames, addresses, and account numbers when transferring crypto assets.

The G20 leaders also expressed support for the Financial Stability Board’s recommendations on regulating crypto activities and markets, as well as global stablecoin regulations. These recommendations, released in July, establish standards for stablecoins similar to those for traditional banks.

They also call on regulators to prevent activities that hinder the identification of relevant participants in crypto transactions, among other measures.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News