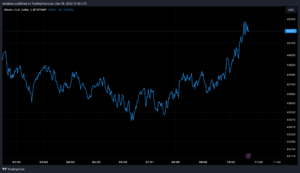

Bitcoin has experienced a notable surge in the past weeks, breaking through consecutive price resistances and reaching new yearly highs, surpassing $44,000 with a 15% gain in the last 7 days.

Beyond the excitement surrounding spot Bitcoin ETFs, on-chain data reveals heightened activity among significant holders. Santiment, an on-chain analytics platform, notes a correlation between the recent BTC price surge and an uptick in the number of wallets holding over 100 BTC.

Bitcoin Whales on the Move: Insights from Santiment Data

Santiment’s recent post highlights a significant trend in the Bitcoin market, revealing a consistent increase in the number of wallets holding 100 BTC or more over the past four weeks. This surge in large holders coincided with Bitcoin’s remarkable gains in October, where whales holding between 100 and 1,000 BTC grew by 16 wallets. This influx of large players contributed to Bitcoin’s ascent, surpassing $30,000 and setting the stage for subsequent weeks.

However, Santiment’s data indicates a notable drop in the number of large wallets on November 9, aligning with a brief period of profit-taking that temporarily lowered Bitcoin’s value from $37,000 to $35,500 by November 15.

Despite this temporary setback, a shift occurred in mid-November, signaling a continued bull rally. Large wallets, those holding 100 BTC or more, began to increase in number once again. In the past four weeks, 48 whale wallets have reentered the scene, suggesting active accumulation by significant players during the ongoing rally. According to Santiment, there are now approximately 16,000 wallets holding 100 BTC or more, reflecting sustained interest and participation from prominent investors.

🐳 #Bitcoin's climb has continued, reaching $44K just 2 hours ago. The amount of existing 100+ $BTC wallets have correlated tightly with this price climb. Since a big drop-off on November 9th, 48 of these whale wallets have returned in the past 4 weeks. https://t.co/4lNBvn1HB3 pic.twitter.com/jJYVsPSbfk

— Santiment (@santimentfeed) December 5, 2023

This data aligns with Bitcoin’s recent climb to $44,000, underscoring the close correlation between the resurgence of large wallets and the upward trajectory of Bitcoin’s price. The return of these whale wallets further emphasizes the enduring confidence and strategic positioning of major players in the Bitcoin market.

Bitcoin’s December Rally: Potential for a Year-End Surge

Historically, December has presented a mixed performance for Bitcoin. However, recent trends indicate a potential shift, especially considering Bitcoin’s previous price gains in October and November. The last occurrence of such gains led to an impressive 46.92% spike in December. If history repeats itself, Bitcoin could surpass $55,000 before the year concludes.

What sets this Bitcoin rally apart is its uniqueness compared to past surges. Key catalysts for significant price increases, such as the next halving and the launch of spot Bitcoin ETFs in the US, are yet to materialize. Santiment’s on-chain metric tracking whale wallets aligns with the sentiment of numerous crypto analysts who predict that the recent surge marks the beginning of an extended bull run expected to extend through 2024.

Bitcoin’s current trading price hovers around $43,767, briefly touching over $44,000. Analyst Ali Martinez, referencing the TD Sequential indicator, suggests a potential price pullback for Bitcoin, possibly retracing to the $37,000 support zone. The TD Sequential indicator signals a correction in the next 7 to 48 hours, based on analyses of the daily and three-day charts. [Ali Martinez Tweet](image link to Ali Martinez tweet).

BTC price reclaims $44,000 | BTCUSD on Tradingview.com

As Bitcoin navigates its December trajectory, the market awaits to see whether historical patterns will repeat and if the ongoing rally signals a sustained upward momentum leading into the new year.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News