The number of active addresses indicates that Litecoin (LTC) is seeing higher transaction activity than Cardano (ADA) at present. Analysts have established mid-term price targets of $0.79 for ADA and $95.37 for LTC.

Despite Cardano having a market cap nearly $10 billion higher than Litecoin’s, Litecoin leads in network activity. According to IntoTheBlock, as of May 31st, Litecoin recorded 357,260 active addresses, while Cardano had only 28,630 active addresses, highlighting a significant difference in user engagement.

Litecoin Leads Cardano in Active Addresses: Analysis and Comparison

Active addresses represent unique wallets involved in successful transactions on a blockchain, without counting the same address multiple times in a day. Litecoin (LTC) has shown 12 times more activity than Cardano (ADA) recently, indicating potentially higher cryptocurrency prices.

As of now, LTC is priced at $84.52, reflecting a 1.53% increase in the last 24 hours. In contrast, ADA is trading at $0.45, indicating relatively sideways movement.

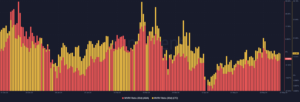

litecoin-cardano-active-addresses. Source: IntoTheBlock

Despite Litecoin’s significant lead in active addresses, there hasn’t been a major development that could explain this wide margin over Cardano. Market participants seem to favor LTC over ADA currently.

However, did Litecoin surpass Cardano across all aspects? One metric to consider is development activity. Cardano has consistently shown strong development activity, with recent data from Santiment indicating a score of 55.57. This metric reflects developer commitment to maintaining blockchain functionality. In contrast, Litecoin’s active address activity hasn’t seen a similar decline.

Development Activity and MVRV Comparison: Litecoin (LTC) vs Cardano (ADA)

At the current moment, development activity on the Litecoin network registers at 0.036, with minimal activity observed in its public GitHub repositories compared to Cardano.

However, in most cases, development activity does not directly influence prices, so the disparity does not necessarily indicate that ADA would outperform LTC.

Cardano-Litecoin-Valuation. Source: Santiment

Moving to MVRV (Market Value to Realized Value), a metric measuring profitability and cryptocurrency valuation:

- As of now, Cardano’s 30-day MVRV ratio stands at -4.932%, suggesting that many ADA holders are experiencing unrealized losses.

- In contrast, Litecoin’s 30-day MVRV ratio is 12.38%, indicating that, on average, LTC holders in the past 30 days have realized profits.

Both cryptocurrencies are currently considered undervalued. If the market enters an extremely bullish phase:

- ADA could potentially rise to $0.79, reflecting market sentiment.

- Likewise, Litecoin might aim for $95.37, considering its current valuation trends.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News