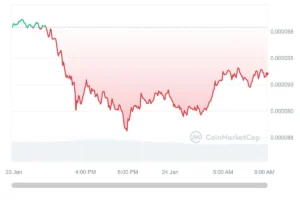

In the midst of crypto market uncertainties, Terra Classic Price’s decline has altered, maintaining a level above $0.0001 and aligning with the 78.6% Fibonacci Retracement level.

This establishes a bearish flag pattern, and a potential breakdown of this pattern may intensify selling pressure. The question arises: Will the LUNC price crash to $0 in 2024? Further details are explored in this Terra Luna Classic price prediction.

Terra’s Digital Payment Network and Terra Classic’s Price Plunge

Terra functions as a digital payment network, streamlining affordable transactions across diverse blockchains. Employing stablecoins like TerraUSD (UST), pegged to real-world currencies such as the US dollar, Terra stands out in the stablecoin landscape.

The recent substantial decline in Terra Classic’s price is linked to Terraform Labs, the company behind TerraUSD, filing for bankruptcy in the US. Legal documents disclose the Singapore-based firm’s bankruptcy petition in Delaware, citing assets and liabilities between $100 million and $500 million.

This bankruptcy announcement has likely impacted Terra Classic and is influencing investor confidence in LUNC, Terra Classic’s associated token. Combined with the general cryptocurrency market downturn, Terraform Labs’ financial woes have heightened the pressure on LUNC.

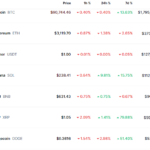

Adding complexity, reports indicate that Crypto.com removed LUNC from its supported tokens, contributing to the decline in LUNC’s price. Currently, LUNC has witnessed nearly a 25% decrease in the past week and a 5% drop in the last 24 hours.

Terra Classic’s Uncertain Future in a Tough Market

Terra Classic faces a tough road ahead due to challenges in the market. When a token’s price drops to zero, it often means the project is struggling. After the issues with Terra, they tried to start fresh with the new LUNA token, but gaining confidence in a struggling cryptocurrency is hard in the current market.

LUNC Daily Chart: Image Source: CoinMarketCap

Experts think Bitcoin might drop below $20,000, affecting the entire cryptocurrency market, including Terra. This could lead to a significant decrease in LUNC’s market value, which is currently around $541 million. While there’s a risk of Terra facing tough times, a complete collapse seems unlikely since Terra is still being used in different projects.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News