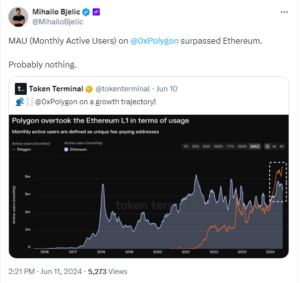

Protocols connected to Ethereum are experiencing a surge in total user numbers, with layer-2 scaling solution Polygon surpassing Ethereum in Monthly Active User (MAU) count.

According to Polygon cofounder Mihailo Bjelic, this update was shared on X, highlighting the platform’s growing influence in the digital currency landscape.

Ethereum’s Growth Dynamics Amid Rising Layer-2 Protocol Popularity

Ethereum, as the foundational network for layer-2 scaling solutions, is facing a shift in user adoption trends towards these secondary protocols. According to Mihailo Bjelic, Polygon’s Monthly Active User (MAU) count has surpassed eight million, outpacing Ethereum’s MAU which remains below this threshold.

Source: X

The significant migration to Polygon is driven by its Dencun Upgrade, which has substantially lowered transaction fees, enhancing the protocol’s attractiveness to users. While Ethereum continues to evolve, the advancements in its layer-2 solutions are providing users with more robust options to engage with the DeFi ecosystem.

Alongside Polygon, protocols such as Base and Optimism (OP) are leading transformative changes in network capabilities. These layer-2 solutions offer improved performance, scalability, and reduced gas fees, making them preferred alternatives for exploring NFTs, gaming, and other innovations in the Web3 space.

Ethereum and Layer-2 Tokens Face Bearish Pressure Amid Market Volatility

Despite showing strong performance in core metrics compared to Ethereum, layer-2 protocols and their associated tokens are currently experiencing a downturn amidst broader market bearishness.

As of the latest update, Ethereum is priced at $3,527.53, marking a 4% decline over the past 24 hours. Concurrently, layer-2 tokens like MATIC, Arbitrum (ARB), and Optimism have also witnessed declines of 1.74%, 2.44%, and 1.6%, respectively, settling at $0.6360, $0.9354, and $2.124.

The Ethereum ecosystem is particularly sensitive now, with attention focused on the potential launch of a spot ETH ETF product. A successful launch could potentially inject bullish momentum into ETH and its associated tokens, providing a positive outlook amidst current market uncertainties.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News