On Thursday, people on Polymarket bet over $13 million on whether the SEC would approve Ethereum ETFs. Afterward, they debated if the approval actually took place.

The U.S. Securities and Exchange Commission (SEC) has approved eight spot Ethereum ETFs, sparking a new debate about what “approved” really means. This argument was particularly intense on Polymarket, where crypto enthusiasts had bet over $13 million that the SEC would approve a spot Ethereum ETF by May 31.

Anticipation and Debate Surrounding Ethereum ETFs

The open wager on Polymarket started on January 9, coinciding with the intense anticipation for the SEC approval of the first Bitcoin ETFs. The main question influencing the potential approval of an Ethereum ETF was whether Ethereum is classified as a security or a commodity, and whether Bitcoin’s approval had paved the way for Ethereum.

Financial analysts and crypto commentators frequently shared their predictions. However, as the SEC took aggressive actions against other crypto projects, these predictions grew increasingly pessimistic. As the May deadline for a decision approached, some suggested that a delay could be beneficial. Last month, JP Morgan estimated the odds of approval at 50%.

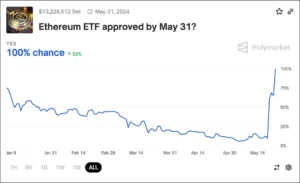

Polymarket users bet on the question, “Ethereum ETF approved by May 31?” Image: Polymarket

Shifting Sentiments and Ethereum ETF Predictions

Last week, the sentiment around Ethereum ETFs began to shift. Coinbase suggested that an Ethereum ETF would become a reality, and two Bloomberg ETF analysts increased their odds of approval from 25% to 75% on Monday. This optimistic outlook caused the price of ETH to soar.

Polymarket bettors were also closely monitoring these developments. The collective odds of SEC approval on the site surged from 13% to over 50% on Monday. When the SEC announced on Thursday that it was approving applications for spot Ethereum ETFs, optimistic wagerers were jubilant. They believed the answer to whether an Ethereum ETF would be approved before May 31 was undoubtedly “yes.”

Clarity and Uncertainty in Ethereum ETF Approval

Following the SEC’s approval of rule changes that permit major investment firms such as Grayscale, BlackRock, Fidelity, and VanEck to proceed with their plans for spot Ethereum ETFs, a Twitter user named Observoor expressed disappointment over the lack of defined terms in the betting process. With $11 million at stake, Observoor pointed out the potential for confusion and disputes, noting that the bet did not clearly specify what “ETF approval” actually meant.

While the SEC’s rule changes are a step forward, they do not guarantee immediate approval of specific funds. Approval for these funds could still take more than a week, potentially extending beyond the May 31 deadline set by Polymarket. This timeline uncertainty adds a layer of complexity to the ongoing debate and speculation surrounding Ethereum ETFs.

Controversy and Debate Over Ethereum ETF Betting

Following the SEC’s approval of Ethereum ETFs, controversy erupted among Polymarket users, with nearly 1,000 comments flooding the event page. Some participants labeled the bet as “rigged,” expressing frustration and accusing the SEC of unexpectedly approving the ETFs after many had anticipated a denial.

One Polymarket user defended the outcome, suggesting that the community had collectively misjudged the SEC’s decision-making, leading to the perception of unfairness. They argued that credible reporting had indicated an approval was likely.

Amidst the discord, another user proposed a compromise: to split the winnings evenly among participants and acknowledge that the rules of the bet had not adequately anticipated the SEC’s actions. This suggestion aimed to address the dissatisfaction and confusion surrounding the outcome of the Ethereum ETF wager.

SEC Decision and Polymarket’s Response

Following the SEC’s clear statement approving Ethereum ETF proposals on an accelerated basis, controversy swirled among Polymarket users regarding the outcome of their bets. Despite some disputing the result, the majority vote confirmed a “yes” by evening, settling the wager definitively.

Defending the platform’s resolution, a Polymarket user emphasized basic reading comprehension and market rules, asserting that the decision aligned with straightforward interpretation. Meanwhile, investor Nick Tomaino highlighted the importance of maintaining trust in prediction market platforms, urging adherence to the market’s intent for long-term credibility.

With the Ethereum ETF bet resolved, the broader crypto market showed muted response, with Ethereum’s price seeing a modest increase of nearly 30% for the week, reaching highs of $3,937 before stabilizing around $3,819.

Established in 2020, Polymarket operates as a blockchain-based prediction market where users can stake tokens on various events, from elections to sports outcomes. Recently, the platform raised $70 million in funding, with contributions from notable figures such as Ethereum co-founder Vitalik Buterin.

In Summary

In recent events surrounding Ethereum ETFs, Polymarket saw over $13 million wagered on whether the SEC would approve them, sparking intense debate upon the SEC’s announcement of approving eight spot Ethereum ETFs. Initially, the bet began amid high anticipation for Bitcoin ETF approvals, with uncertainty over whether Ethereum would be classified as a security or commodity. As sentiment fluctuated, predictions grew pessimistic amidst SEC actions against crypto projects, but shifted positively when analysts revised approval odds. Coinbase and Bloomberg analysts bolstered confidence, leading to a surge in ETH prices and Polymarket’s betting odds.

Following the SEC’s rule changes enabling firms like Grayscale and BlackRock to proceed with ETF plans, confusion arose over what constituted “approval.” Despite a clear SEC statement, controversy on Polymarket ensued, with users questioning the bet’s fairness and terms. Ultimately, a majority affirmed the “yes” outcome, prompting reflections on market integrity and trust by participants like Nick Tomaino. Meanwhile, Ethereum’s market response was moderate despite its price briefly spiking to $3,937 before stabilizing around $3,819.

Established in 2020, Polymarket continues to operate as a blockchain prediction market, securing $70 million in recent funding with backing from Ethereum co-founder Vitalik Buterin and facilitating predictions on diverse events, from elections to sports outcomes.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News