Stripe, a major financial technology company, has introduced a new service to help businesses easily integrate cryptocurrencies into their product offerings

Stripe, a big player in the fintech industry, has unveiled a new service that makes it simple for companies to include digital currencies in their products.

Usually, Stripe provides a platform for crypto-related businesses to accept fiat globally and expand their services. It even accepts stablecoins like USDC for payouts, which makes it popular among crypto organizations.

Using Stripe products, crypto companies can simplify their onboarding process and minimize their risk of fraud.

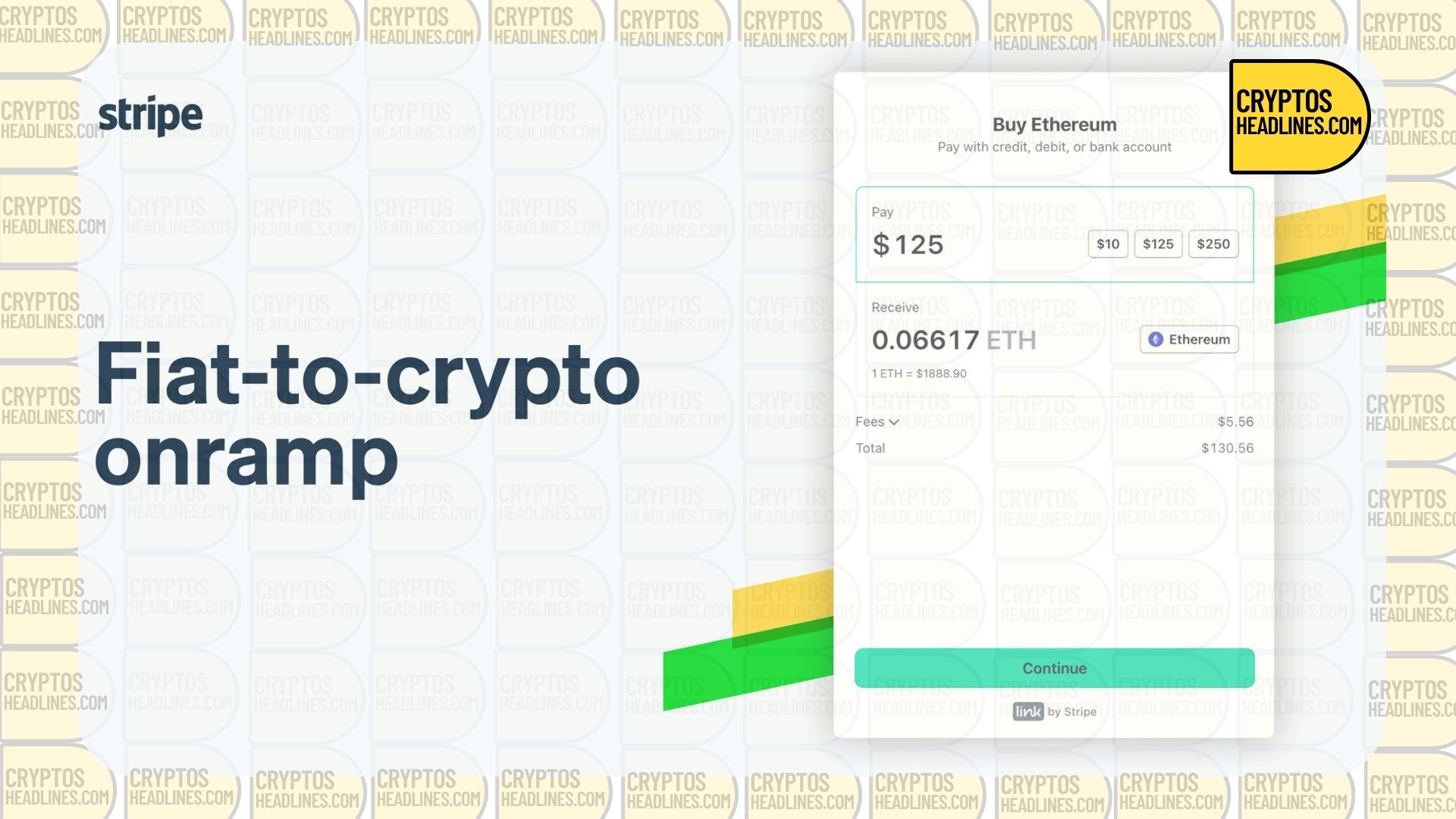

Today Stripe launched a crypto onramp.

This is low-key a HUGE deal.

I've spoken with several Fortune 500s who have fully built crypto strategies but haven't launched yet because they don't have a trusted brand to handle the onramp and the wallet.

Stripe just solved the onramp. pic.twitter.com/hPst39VkA5

— Yano 🟪 (@JasonYanowitz) May 5, 2023

Fintech firms aim to compete with crypto exchanges.

Stripe is now competing with other fintech companies like MoonPay, Transak, and Simplex by offering a service that allows users to buy cryptocurrencies instantly.

When buying a Non-fungible token (NFT) on Web 3.0, users can purchase Ethereum (ETH) instantly instead of waiting for several days for external transfers, which is the case on most crypto exchanges.

Usually, digital asset service providers wait for deposits to clear, especially when using a linked banking method. But with Web 3.0 companies, users can either buy crypto through Stripe’s onramp or customize their crypto-purchasing widget on their website. The second option, known as an embedded on-ramp, was announced in December 2022.

Web 3.0 companies have two options to integrate with Stripe’s onramp service. They can either redirect their users to purchase crypto on the Stripe-hosted onramp without any coding, or use an embedded on-ramp that requires 10 lines of code. James Mudgett, VP of Web3.0 products at Brave, expressed his excitement about partnering with Stripe, saying that the fiat payment solution will help them reach new Web3 users.

Financial technology companies are increasingly making moves in the cryptocurrency industry. For instance, Revolut, a digital bank, recently launched its services in Brazil, marking its first expansion into Latin America. Meanwhile, PayPal introduced a new feature that enables users to transfer cryptocurrencies between its platform and other wallets.