In March, the decentralized liquidity protocol saw its highest-ever monthly trading volume, reaching record levels. However, despite this success, some Bitcoin enthusiasts remain cautious about using the protocol for borrowing.

THORChain, a decentralized liquidity protocol, has achieved a significant milestone by surpassing $10 billion in total monthly trading volume for the first time ever. Meanwhile, Bitcoin’s price has dropped to $70,095, sparking debate among its supporters about the safety of using THORChain for borrowing.

THORChain Milestone and Bitcoin Maximalist Debate

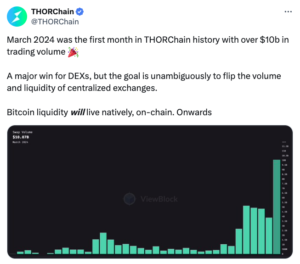

On March 27, the official social media account for THORChain, known as X, proudly announced a historic milestone. Runscan data revealed that the decentralized liquidity protocol had surpassed $10.26 billion in trading volume for the month.

Source: THORChain

Following this announcement, a lively debate ensued among Bitcoin maximalists regarding the security of THORChain and its suitability for Bitcoin holders seeking interest-free loans. Mathematician and Bitcoin investor Fred Krueger ignited the discussion by endorsing THORChain as a “real” platform, indicating that BTC-backed loans on the protocol were a safe option for those seeking liquidity.

However, Bitcoin analyst Dylan Le Clair challenged Krueger’s assertion, expressing skepticism about the safety of Bitcoin collateralized loans on THORChain. Le Clair argued that relying on the exchange rate of an altcoin for a “0% interest, no liquidation risk” loan merely shifts the risk rather than eliminating it.

Source: Fred Krueger

THORChain operates as a decentralized liquidity protocol facilitating seamless asset swaps across various blockchains. It enables users to obtain interest-free loans against major cryptocurrencies like Bitcoin and Ethereum without imposing liquidations or fixed expiry dates.

THORChain’s Evolving Lending Model

In its latest upgrade on January 30, THORChain implemented significant changes to its collateral requirements for Bitcoin and Ether. These requirements were reduced from 400% to 200%, enabling users to borrow up to half of the total value of their provided assets.

On March 10, analyst Chris Blec commented on THORChain’s no-liquidation lending model, describing it as “interesting.” However, he highlighted two major concerns associated with this concept.

Firstly, investors face the risk of lending their Bitcoin to a protocol that may collapse or become vulnerable to exploitation. THORChain experienced such an incident in 2021, although the funds were ultimately returned.

Secondly, investors are dependent on a centralized provider not altering its terms and conditions in the future, potentially exposing their loans to unforeseen risks.

It’s worth noting that THORChain encountered difficulties in 2023, forcing the protocol to halt its mainnet twice due to reported security vulnerabilities. These incidents underscore the ongoing challenges in maintaining the security and stability of decentralized platforms like THORChain.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News