Uniswap has seen a shift in traffic, with a lot of new growth coming from Base users. By adding smart wallets and lowering fees, Uniswap has become more accessible to retail traders.

Uniswap user inflows have increased following the Base campaign of “Onchain Summer.” Base provides easier access through smart wallets that resemble web logins. Uniswap is growing its user base and generating significant positive earnings, with Uniswap V4 expected in the coming months.

Uniswap’s Current Landscape and Market Position

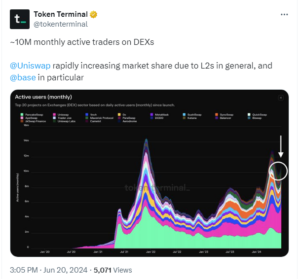

Uniswap operates on Ethereum and major Layer 2 scaling solutions, attracting users, stablecoins, and ERC-20 tokens. Recently, there has been a notable increase in user profiles, with Base users contributing significantly to monthly active users. This trend has bolstered Uniswap’s market share and helped revive decentralized exchange (DEX) trading, which now boasts 10 million monthly active users, partly driven by automated trading activity.

Source: X

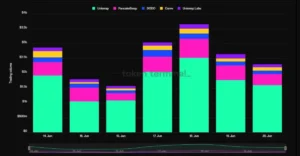

The exchange dominates trading volume within the Ethereum ecosystem and new Layer 2 chains like Base, as reported by TokenTerminal. However, Aerodrome DEX, also on the Base blockchain, competes closely in trading fees and revenue efficiency.

Ethereum ecosystem and new L2 chains like Base. Source: TokenTerminal

Uniswap Labs reports daily earnings ranging from $200,000 to $400,000, driven by up to 460,000 active daily wallets interacting with the platform. It leads in direct deposits and continues to serve as a primary listing venue for various tokens, excluding those associated with the Solana ecosystem and Raydium DEX.

Despite its strong position, Uniswap faces competition in riskier trades and specialized protocols but remains the most widely used swap service. It has seen a surge in new liquidity pool launches, some requiring as little as 1 ETH, predominantly paired against various forms of Wrapped Ether (WETH) and exhibiting high volatility.

Despite recent positive developments, UNI tokens trade at $9.80, down 50% from their yearly peak. Nonetheless, UNI has gained over 100% in the past year, reflecting renewed interest in DEX platforms and the expansion of token trading opportunities facilitated by new tools and protocols.

Uniswap’s Expansion and Integration with Base

Uniswap’s growth on Base aligns with the chain’s initiative to onboard mainstream users, leveraging smart wallets that offer a user-friendly internet login experience with robust security akin to self-custodial wallets. Integration with Moonpay further streamlines new Base accounts’ access to Uniswap, enhancing accessibility and user engagement.

Source: X

Previously, Uniswap played a pivotal role within the Ethereum ecosystem but faced criticism for high fees that hindered retail traders and casual crypto enthusiasts alike.

Despite challenges, Uniswap has rebounded with a locked value of $5.67 billion, following a period of active token generation. Uniswap V3 records substantial daily trading volumes, including over $877 million on Ethereum, $80 million on Polygon, and $57 million on Optimism. Notably, Uniswap V3 on Base has surpassed smaller blockchains, boasting more than $163 million in daily trading volumes.

These volumes reflect accelerated growth rates, surpassing levels seen during the 2021 bull market. Increased activity on Layer 2 solutions and broader adoption continue to bolster Uniswap’s resilience amidst market fluctuations in 2024.

Uniswap V4: Enhancing Decentralized Exchange Functionality

Uniswap announced the upcoming V4 a year ago, with expectations for launch during the summer or fall months of this year. Unlike traditional exchanges with order books, V4 aims to introduce similar features in a decentralized manner. However, decentralized orders are vulnerable to issues like bot frontrunning, MEV (Miner Extractable Value) bot activity, and sandwich attacks. Uniswap intends to optimize liquidity management to provide a more predictable trading environment, minimizing unexpected losses for users, especially newcomers.

The next iteration of Uniswap will support on-chain limit orders and introduce a time function to facilitate the gradual execution of large orders. Notably, all liquidity pools will be consolidated and managed by a Pool Manager, capable of overseeing liquidity across multiple orders. Additionally, Uniswap V4 will optimize gas usage and fees by only moving net balances during swaps, while maintaining genuine on-chain trading experiences.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News