Solana (SOL) has skyrocketed to a new high in 2023, and it seems like SPL tokens, along with a surge in DeFi (Decentralized Finance) and NFT (Non-Fungible Token) activities, are the key drivers behind this impressive growth.

The popularity and increased usage of these tokens, combined with the vibrant activities in decentralized finance and non-fungible tokens, contribute to SOL’s remarkable rise.

Solana’s Recent Surge: Influencers and Token Integrations

Solana’s native token SOL experienced a notable 17% surge between December 7 and December 8, reaching its highest level since May 2022.

The turning point for SOL occurred on December 1 when Brian Armstrong, the CEO of Coinbase, unveiled plans to integrate the Solana network and its tokens, although no specific date was provided. This revelation triggered heightened interest in Bonk (BONK), a Solana SPL meme token available on Bybit, KuCoin, and Solana’s decentralized exchange, Orca. Notably, Bonk surged by an impressive 236% between December 1 and December 8.

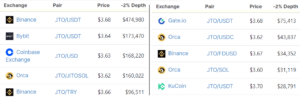

Coinbase further contributed to Solana’s momentum on December 6 by announcing the listing of Jito (JTO), an SPL token on the Solana network. JTO saw immediate success, doubling in price between December 7 and December 8. With a circulating supply of 115 million, Jito’s market capitalization now stands at $422 million.

The governance token of Jito, a Solana-based liquid staking protocol, initiated an airdrop of 80 million tokens to early users, validators, and protocol contributors. This resulted in a noteworthy distribution, with approximately 9,900 addresses staking SOL using Jito before the snapshot date. Each participant received an impressive 4,941 JTO tokens.

Jito, functioning as a decentralized finance (DeFi) application, enables users to leverage SOL staking and receive a derivative JitoSOL token, providing additional flexibility and yields. This practice mirrors common approaches in the Ethereum ecosystem, such as the Lido platform. According to Coingecko’s order book depth, Binance is leading the JTO market with bids totaling $606,000.

Jito markets ranked by -2% bids on Dec. 8, USD. Source: Coingecko

Solana’s Allure: Comparisons and Airdrop Potential

In gaining a comprehensive perspective, applying a similar analytical approach, the $4.83 billion Uniswap (UNI) decentralized exchange governance token presents itself with a liquidity parallel of $598,000 at Binance.

Investors swiftly recognized the potential for similar gains through additional airdrops within the Solana ecosystem, thereby fostering an increased demand for SOL tokens.

Highlighted by analysts and Solana experts, including Patrick Scott, various projects within the ecosystem operate on a points system, adding an intriguing dimension. These projects include MarginFi (a lending platform), Tensor (an NFT exchange), Jupiter (an aggregator), Kamino (a lending platform), and Parcel (a real estate speculation platform). The points-based system in these ventures contributes to the growing interest in SOL tokens, further solidifying Solana’s position in the crypto landscape.

Potential Solana ecosystem airdrops that you can still qualify for:

MarginFi – Borrowing/lending (active points system)

Tensor – NFT exchange (active points system)

Drift – perp dex

Kamino – Borrowing/lending (upcoming points system)

Parcl – Real estate speculation (upcoming…— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) December 8, 2023

Solana’s Momentum: Airdrop Guidance and Market Dynamics

Analyzing Airdrop Opportunities: For those seeking insights, @Dynamo_Patrick, an analyst and CoinBeats co-founder, provides a detailed Twitter thread offering step-by-step guidance on potential Solana airdrops.

SOL’s Peculiar Rally Amid Smartphone Sales Disappointment: Interestingly, SOL surged above $72 shortly after Solana revealed that its Saga smartphone sold only 2,500 units, falling short of their minimum user base target. Co-founder Anatoly Yakovenko hinted at a project review, citing the rise of progressive web apps bypassing Android and iOS store fees. The use of “passkeys” reduces the need for a secondary phone to generate seed phrases, despite lacking a trusted display, according to Yakovenko.

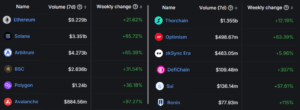

Underlying Strength in Solana Network Activity: Contrary to weak smartphone sales and broader DeFi stagnation, SOL’s token gains find support in the Solana network’s improved activity and deposits. Notably, the total value locked (TVL) in DeFiLlama has surged by 36% since November 15, marking the lowest level in over two years.

DEX Activity Surge and Competitive Landscape: Solana’s decentralized exchanges (DEX) activity spiked by 65.7% in the last 7 days. Despite competition from Ethereum and BSC Chain, which saw gains of 21.6% and 31.5%, respectively, Solana maintains its prominence.

DEX 7-day volume rankings, USD. Source: DefiLlama

NFT Boom and Dominant Players: Solana’s non-fungible token (NFT) activity soared, registering $15.2 million in sales with 16,489 buyers in the last 24 hours. Key players in Solana’s NFT markets include the Tensorians collection with $4.6 million in sales, Mad Lads with $1.7 million, and Quekz with $832,000.

NFT activity past 24 hours, USD. Source: CryptoSlam

SOL’s Rally Drivers: SOL’s recent surge above $72 is attributed to SPL token listings on major exchanges, heightened DeFi and NFT activities, and the anticipation of additional airdrops following the success of Jito.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News