BlackRock’s updated ETF model boasts “superior resistance” to market manipulation, addressing a key concern that the SEC has historically cited in rejecting spot Bitcoin ETFs.

BlackRock has made changes to its application for a Bitcoin exchange-traded fund (ETF) to make it simpler for Wall Street banks to get involved. Now, banks can create new shares in the fund using cash, not just cryptocurrency. This adjustment aims to broaden participation and ease access for traditional financial institutions.

BlackRock’s Innovative Model for Bitcoin ETF Approval

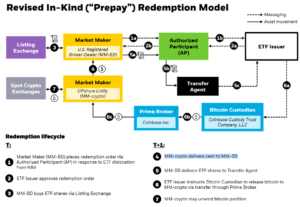

BlackRock has introduced a groundbreaking in-kind redemption “prepay” model in its Bitcoin exchange-traded fund (ETF) application. This modification facilitates major banks like JPMorgan and Goldman Sachs to act as authorized participants (APs), enabling them to bypass restrictions preventing direct holdings of Bitcoin or crypto on their balance sheets.

In a pivotal meeting on Nov. 28 with the United States Securities Exchange Commission (SEC), six BlackRock members and three from NASDAQ presented the new model. If approved, it could significantly impact Wall Street banks with trillion-dollar balance sheets, as regulatory constraints often hinder their direct involvement with Bitcoin.

Under the revised model, APs transfer cash to a broker-dealer, which then converts the cash into Bitcoin. This Bitcoin is subsequently stored by the ETF’s custody provider, with Coinbase Custody playing this role in BlackRock’s case. Notably, the new structure redistributes risk away from APs, placing more responsibility on market makers.

BlackRock emphasizes that the innovative model provides “superior resistance to market manipulation,” a key factor that has led to repeated rejections of previous spot Bitcoin ETF applications by the SEC.

BlackRock’s revised in-kind redemption model presented to the SEC on Nov. 28. Source: SEC

In addition to addressing market concerns, BlackRock asserts that the new ETF structure enhances investor protections, reduces transaction costs, and promotes simplicity and harmonization throughout the broader Bitcoin ETF ecosystem.

BlackRock’s Ongoing Interactions with the SEC for Bitcoin ETF Approval

BlackRock, in its pursuit of a Bitcoin exchange-traded fund (ETF), has engaged with the Gary Gensler-led U.S. Securities and Exchange Commission (SEC) for the third time on Dec. 11, as revealed in a recent SEC filing.

Damn, the SEC is busier than Santa's elves. BlackRock's third meeting with them yesterday is the most notable IMO as everyone is waiting to see if they can convince SEC to allow in-kind creations in the first run of approvals. https://t.co/r2jqgpg87m

— Eric Balchunas (@EricBalchunas) December 12, 2023

This meeting followed BlackRock and NASDAQ’s second encounter with the SEC on Nov. 28, which served as a continuation of their initial discussion on Nov. 20. During the first meeting, BlackRock presented its original in-kind redemption model.

The SEC is tasked with reaching a decision on BlackRock’s ETF application by Jan. 15, with the final deadline set for March 15.

Simultaneously, ETF analysts anticipate the SEC to render decisions on several pending spot Bitcoin ETF applications around Jan. 5-10. Notable financial firms such as Grayscale, Bitwise, VanEck, WisdomTree, Invesco Galaxy, Fidelity, and Hashdex are among those awaiting the SEC’s verdict during this timeframe.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News