The metrics of the BNB network showed significant growth in the last quarter, despite Binance Smart Chain (BNB) experiencing fluctuations due to regulatory scrutiny faced by Binance in recent months.

BNB network’s metrics demonstrated growth in the last quarter, although bearish sentiment around BNB intensified with the rise in short positions.

Burgeoning Growth Amidst Challenges: BNB Network Insights

Despite facing regulatory scrutiny and challenges, the BNB network continued its growth trajectory. In the first quarter of 2024, the network witnessed a substantial surge in revenue, reaching $66.8 million, marking a remarkable 70% increase from the previous quarter’s revenue of $39.2 million.

The surge in revenue was primarily fueled by the appreciation in the value of BNB. Gas fees from DeFi transactions remained the main revenue source, contributing 76,200 BNB, representing a 1.7% increase from the previous quarter. DeFi transactions accounted for 46% of total revenue.

Stablecoins experienced significant quarter-on-quarter revenue growth, rising from 19,500 to 25,100 BNB, a 29% increase. Conversely, the Gaming and Infrastructure categories saw notable declines in revenue.

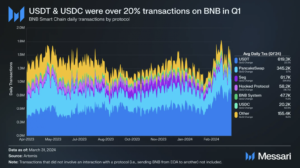

Despite a 9% decrease in average daily transactions from Q4, average daily active addresses saw a substantial 26% increase from 1.0 million to 1.3 million. Several protocols on the BNB Smart Chain also witnessed upticks in average daily transactions.

USDT emerged as one of the leading protocols with 619,300 daily transactions, marking a 22% increase from the previous quarter. PancakeSwap followed closely with 345,200 daily transactions, up by 4%. Together, they accounted for 74% of protocol transactions, indicating a 10% increase from the previous quarter.

Overall, daily average transactions involving protocols increased by 5% from 1.2 million to 1.3 million, showcasing sustained activity within the BNB network.

Source: Messari

BNB Price Update and Trader Sentiment

At the time of writing, BNB was priced at $607.05, experiencing a decline of 1.41% over the last 24 hours. Additionally, the trading volume for BNB had also decreased by 9% during this period.

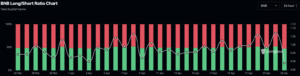

Despite the positive performance exhibited by the BNB network, trader sentiment surrounding the BNB token remained skeptical. In recent days, a significant majority of traders opted to short the BNB token.

Source: Coinglass

The percentage of short positions concerning BNB had risen to 52%. It remains uncertain whether the prevailing bearish sentiment will accurately predict BNB’s future performance.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News