Bitcoin’s price is once again rising, signaling that the bulls are back in control. After a week of declines and negative flows into spot BTC exchange-traded funds (ETFs).

The price of Bitcoin has surged past $70,000 for the first time in a week, reaching $70,921. Now, traders are wondering if this upward momentum will lead to a new all-time high for Bitcoin.

Bitcoin Price Surges on TradingView: Is This a Sign of Recovery?

According to data from TradingView, Bitcoin’s price experienced a notable climb on March 25th, starting at $67,212 and reaching an intra-day high of $70,306. At the time of reporting, Bitcoin was trading at $70,268, marking a 7.5% increase over the past 24 hours.

BTC/USD daily chart. Source: TradingView

This rise in Bitcoin’s price comes after a period of decline, during which the cryptocurrency dropped to as low as $60,771. These fluctuations were further supported by negative inflows into ETFs. Now, with multiple Bitcoin price metrics showing signs of improvement, investors are left wondering if this surge could indicate a potential recovery for the cryptocurrency.

Crypto Investment Products Witness Significant Outflows

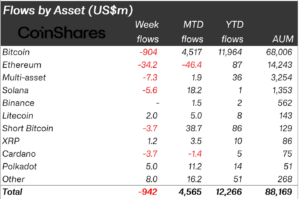

A report by CoinShares on March 25 highlighted the conclusion of a 7-week cycle of inflows into crypto investment products, with investors withdrawing over $942 million. This marked a notable shift as it was the first outflow recorded after a record-setting streak of 7 weeks, during which inflows totaled $12.3 billion.

The substantial outflows were attributed by the crypto asset management firm to a recent drawdown in crypto prices, resulting in a $10 billion reduction in total assets under management (AuM). Despite this downturn, AuM remains above previous cycle highs at $88 billion.

Source: CoinShares

According to CoinShares analyst James Butterfill, the recent price correction caused hesitancy among investors, resulting in significantly lower inflows into new ETF issuers in the US. These inflows amounted to $1.1 billion, partially offsetting the substantial $2 billion outflows witnessed by incumbent Grayscale in the same period.

Bitcoin Dominates Outflows in Crypto Market Sentiment Shift

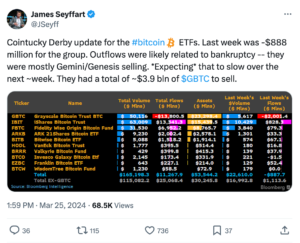

The recent poor sentiment in the crypto market was primarily concentrated on Bitcoin, which accounted for a significant portion of the outflows. According to reports, Bitcoin alone represented “96% of the flows,” totaling $904 million, while short-Bitcoin products also experienced minor outflows amounting to $3.7 million.

Weekly flows by asset. Source: CoinShares

Bloomberg analyst James Seyffart suggested that the substantial outflows observed in spot Bitcoin ETFs last week may have been influenced by bankrupt lender Genesis selling shares of GBTC (Grayscale Bitcoin Trust). This move likely contributed to the overall negative sentiment surrounding Bitcoin in the market.

Source: James Seyffart

Bitcoin’s Age Consumed Metric Surges, Signaling Network Activity Revival

Recent data from market intelligence firm Santiment reveals a notable surge in Bitcoin’s Age Consumed metric over the past few days. On March 23, the number of dormant BTC addresses moving Bitcoin reached 162.89 million, marking the highest level seen in over two years.

Bitcoin: Age consumed. Source: Santiment

Age Consumed serves as a metric tracking the movement of previously inactive BTC coins. It calculates the number of BTC changing addresses daily multiplied by the number of days since they last moved. Spikes in this metric indicate a potential increase in price volatility.

The significant spike in Age Consumed indicates that previously dormant addresses holding Bitcoin are now becoming active again, signaling a revival in network activity. This uptick in activity is further supported by a surge in transaction volume, as evidenced by data depicted in the chart below.

Bitcoin transaction volume. Source: Santiment

As Bitcoin’s Age Consumed metric continues to grow, transaction volume also increases, serving as a precursor to potential price surges in the BTC market.

Altcoins Shine as Bitcoin Sees Modest Growth

According to the CoinShares report, altcoins performed favorably last week, experiencing a net inflow of $16 million. Notable among these were Polkadot (DOT) with $5 million inflows, Avalanche (AVAX) with $2.9 million, and Litecoin (LTC) with $2 million.

Several large-cap altcoins have outpaced Bitcoin’s performance over the past week, led by BNB Chains (BNB), Dogecoin (DOGE), and Toncoin (TON), which recorded gains of 7%, 20%, and 46%, respectively, over the last seven days, as per data from CoinMarketCap. Meanwhile, Bitcoin saw a modest 4.5% increase during the same period, surpassing most altcoins including Ethereum.

As of the report’s publication, the total crypto market cap stood at $1.191 trillion, representing a 43% decline from the peak of $1.707 trillion reached in November 2021. The weekly relative strength index suggests that the altcoin market remains in the overbought region at 83, indicating a favorable outlook for further upside.

Total altcoins market capitalization. Source: TradingView

Independent analyst ChiefRat acknowledges these overbought conditions, anticipating a new all-time high for the altcoin market cap in 2024 but also noting a potential support test at $960 billion. Sheldon The Sniper shares a similar sentiment, suggesting that a squeeze from Bitcoin and a decrease in dominance could trigger a significant altcoin rally, bringing the market closer to a true altseason.

Altcoin season index. Source: Blockchain Center

However, despite the optimism, Bitcoin still dominates the market at 51.77%, according to data from CoinMarketCap. Additionally, the Altcoin Season Index by Blockchain Center has dropped to 49, indicating that the altcoin season has not yet arrived. According to Blockchain Center, an altcoin season can only be declared when 75% of the top 50 coins outperform Bitcoin over the last season (90 days).

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News