Following a significant increase in value, the price of BONK has dropped by more than 20% in the past 24 hours. This prompts the question: Is the bearish trend starting to dominate?

Bonk (BONK) had an impressive run in the past month, with its price soaring by more than 600%. This surge catapulted BONK into the top 100 cryptocurrencies by market capitalization. However, a shift has occurred as the token experienced a double-digit decline in the last 24 hours.

The sell-off initiated by whales and traders commenced shortly after BONK got listed on Binance. Market indicators are now showing a bearish outlook, indicating the possibility of a continued decline in the token’s price.

BONK’s Rollercoaster Ride: From Binance Listing to Market Setback

For a considerable time, the price movement of the new meme coin, BONK, remained relatively unnoticed. However, at the beginning of December, everything changed. The surge was so significant that BONK surpassed Shiba Inu (SHIB), securing the position of the second-largest meme coin.

The catalyst behind this notable shift was Binance listing BONK, sparking heightened interest among investors and resulting in a substantial surge in buying pressure.

Amidst this positive momentum, Token Unlocks shared insights on BONK’s token allocation via a tweet. The revelation indicated that 64.7 trillion BONK tokens, constituting 64.7% of its total supply, had been unlocked. However, the optimism took a hit as BONK’s daily chart turned red.

📢 We are excited to announce that $BONK is now listed on TokenUnlocks, in addition to @binance 📢

Here's the vesting information for @bonk_inu 📊:

– 64.57% of $BONK has already been unlocked.

– FDV value of $3.0 billion.

– Currently, emissions are set at 19.16b $BONK per day… pic.twitter.com/YKoTW4OKgG— Token Unlocks (@Token_Unlocks) December 15, 2023

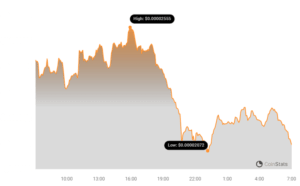

According to Coinstats, the meme coin experienced a downturn of more than 20% in the last 24 hours. At the time of reporting, BONK was trading at $0.00002182, boasting a market cap exceeding $1.47 billion, securing its position as the 51st largest crypto.

Bonk-Price-Chart-2

Analyzing Lookonchain’s data shed light on a potential source of trouble. A trader reportedly sold 52.3 billion BONK, equivalent to $927 thousand, shortly after its Binance listing. Additionally, suspicions arose regarding DWFLabs depositing 50 billion BONK, amounting to $1.6 million, into Binance.

As #Binance announced the listing of $BONK, the price of $BONK rose above $0.00003, an increase of more than 1000% within a month.

A trader sold 52.3B $BONK($927K) today and made ~$784K.

This trader bought 69B $BONK at ~$0.0000021 and staked from Oct 30 to Nov 29. pic.twitter.com/DxMyv7u66E

— Lookonchain (@lookonchain) December 15, 2023

This influx of selling pressure became evident, leading to a significant downturn in the meme coin’s price. The intricate dynamics between BONK’s listing, token unlocks, and market actions highlight the volatility and challenges faced by meme coins in the crypto space.

Analyzing BONK’s Price Decline and Market Indicators

Examining the daily chart of the meme coin provides insights into the potential duration of its price decline. Both the Relative Strength Index (RSI) and Money Flow Index (MFI) for the memecoin were in overbought zones, indicating the likelihood of increased sell pressure and a potential continuation of the price decline. On the flip side, the Moving Average Convergence Divergence (MACD) continued to favor the bulls.

Despite the drop in its price, the meme coin maintained a high social volume, remaining a prominent topic of discussion. The weighted sentiment also experienced a spike, signifying a prevailing positive sentiment surrounding the meme coin.

Interestingly, while the meme coin faced a price decrease, it played a role in a significant achievement for Solana. Solana announced the availability of 30 million BONK token airdrops for Saga phone owners. This announcement fueled a surge in demand for Saga phones, with Solana later confirming the sale of all Saga units.

The Saga is SOLD OUT!

Words cannot describe how much we appreciate your support. We are nothing without this amazing community 🫂

While these past few days will be cemented in our history, we’re excited for the future 🫡

Stay tuned ✨ pic.twitter.com/KJje8lBDLL

— Solana Mobile 2️⃣ (@solanamobile) December 16, 2023

This interplay of market indicators, social sentiment, and strategic partnerships showcases the multifaceted dynamics impacting the meme coin and its ripple effects on associated projects like Solana.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News