Bitcoin’s price is experiencing one of its longest consolidation periods ever, with increased FUD raising the chances of a rebound. After dipping below $61,000 on May 9th, Bitcoin has shown signs of bouncing back, gaining 2% in the last 24 hours and returning to around $63,000.

The price has mostly stayed within the range of $61,000 to $64,000. Yet, data suggests that Bitcoin might be on the brink of breaking out of this consolidation phase.

Bitcoin Retracement Analysis: Implications for Market Dynamics

Crypto analyst Rekt Capital’s latest analysis reveals that the ongoing retracement in the crypto market has surpassed previous records. With a decline of -23.6%, it now holds the title for the deepest pullback, overtaking the -22.9% retracement observed in early 2023. Moreover, this retracement has endured for nearly 50 days, making it one of the longest in this cycle.

Bitcoin’s current pullback has surpassed the depths of any previous retracement in this cycle, indicating a notable shift in market dynamics. Additionally, recent reports suggest a surge in Bitcoin whale activity, indicating strong accumulation sentiments.

The longest pullback cycle in the past lasted for 63 days, suggesting that the Bitcoin price retracement is nearing its end. A breakout from this consolidation phase is anticipated, especially if Bitcoin manages to surpass the $64,000 mark. This could potentially propel Bitcoin towards $70,000 levels and new all-time highs beyond.

Deepest pullback in this cycle?

This current retrace is officially the deepest (-23.6%), recently eclipsing the -22.9% retrace from early 2023

Longest pullback in this cycle?

63 days

This current pullback is -23.6% deep and almost 50 days long

Bitcoin has already… pic.twitter.com/vAz7N16ZdE

— Rekt Capital (@rektcapital) May 9, 2024

Rekt Capital’s analysis suggests that Bitcoin’s consolidation within its current price range, potentially reaching up to $70,000 post-Halving, could signal a deceleration of the cycle. This phase might contribute to a resynchronization with Bitcoin’s regular Halving Cycle, historically characterized by recurring patterns. Speculations indicate a Bull Market peak around mid-September to October 2025.

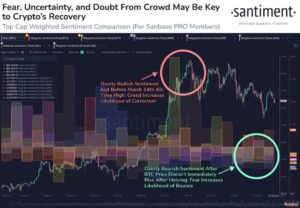

Market Sentiment Analysis by Santiment: Impact on Bitcoin and Altcoins

According to on-chain data provider Santiment, the current market sentiment is predominantly bearish due to the absence of an immediate price jump in Bitcoin following its halving. This fear, uncertainty, and doubt (FUD) increase the likelihood of a bounce in the market.

Sentiment remains largely negative towards the top-cap assets in the cryptocurrency sphere. This negative sentiment has persisted since the Bitcoin halving on April 19th, which did not result in an immediate increase in market caps across the cryptocurrency space.

Courtesy: Santiment

Amidst heightened uncertainty, Santiment reports that the departure of small wallets from the sector could potentially act as a catalyst for Bitcoin and numerous altcoins to undergo gradual recoveries leading up to summer.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News