LINK has surged over 30% in the past nine days, with over $300 million worth of tokens unlocked in the last 24 hours.

Chainlink (LINK) has been on a remarkable upward trend lately, reaching price levels not seen in years. With this momentum, many are wondering when LINK might hit the $20 mark.

Chainlink’s Recent Price Movement

An examination of Chainlink’s daily timeframe chart reveals a consistent upward trajectory over the past few days. Apart from a minor decline on January 31st, LINK has been on an upward trend for the last eight days. During this period, it has seen a remarkable gain of over 30%.

On February 1st, LINK experienced an 11.4% surge, reaching around $17.1. By the end of February 2nd, it registered a further increase of over 3.7%, briefly trading above $18, marking its highest point since April 2022.

Technical Analysis and Indicators

The chart indicates that the LINK price trend is now positioned above its short Moving Average (yellow line), which previously served as resistance but has now become a support level. Additionally, at the time of writing, LINK was nearing the overbought zone on its Relative Strength Index (RSI).

Source: Trading View

With LINK priced around $18 and showing a 1% increase at the time of writing, there’s potential for it to breach the 70 threshold on the RSI, indicating entry into the overbought zone if the upward momentum persists.

Chainlink’s Price Trend and Market Activity

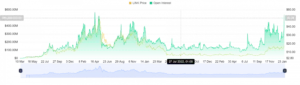

The positive price trend of Chainlink has attracted increased attention and investments from traders, according to data from Coinglass. Analysis of the LINK Open Interest on Coinglass reveals it currently stands at over $540 million, reaching levels last seen in April 2021. This surge in open interest indicates a notable influx of new capital into the market.

Despite Chainlink’s price surge, approximately 19 million LINK tokens, valued at around $341 million, were unlocked from three non-circulating supply contracts. Spot on Chain data shows that 15.95 million LINK, equivalent to about $287 million, was transferred to Binance, while 3.05 million LINK, valued at $54.3 million, was sent to a multi-sig wallet.

Source: Coinglass

Price Movement Analysis

Analysis of the LINK movement on a four-hour timeframe revealed a temporary decline of around 4% before witnessing a recovery. This suggests that the recent unlocking of assets did impact the price momentarily, but it quickly bounced back.

With the current positive price recovery, LINK has the potential to reach $20 in the coming weeks. However, a price correction may occur before it resumes an upward trajectory and enters the $20 price range.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News