The issuer of the second-largest stablecoin globally aims to decrease its vulnerability to potential defaults on US debt.

Circle, the issuer of a popular stablecoin, has reportedly made changes to its reserves treasury in an attempt to minimize the potential risks associated with United States debt defaults.

In a newsletter from Politico on May 10, Circle CEO Jeremy Allaire revealed that the company has made changes to the composition of reserves supporting its stablecoin, USD Coin (USDC), valued at $1.00. To mitigate the risk of a potential US debt default, Circle has shifted to using short-dated U.S. Treasuries.

He mentioned that the company has chosen to avoid holding Treasuries that mature after early June in order to minimize their exposure to debt.

“We want to avoid any potential risk of the U.S. government being unable to repay its debts,” he explained.

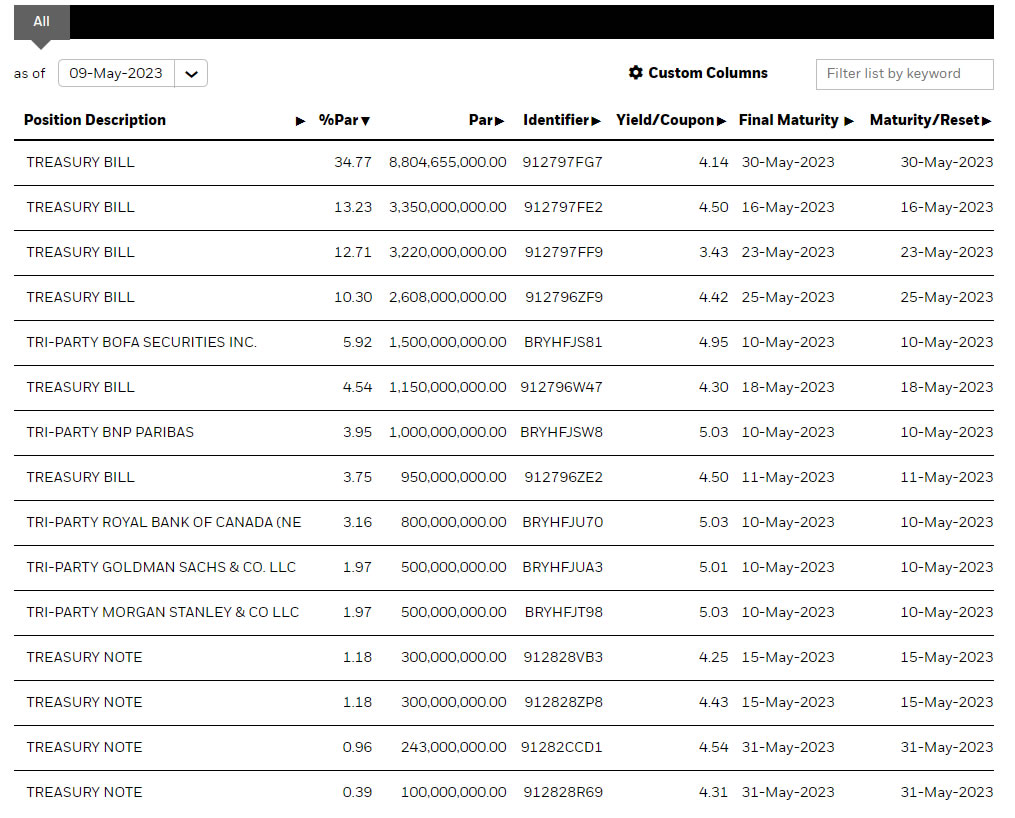

The Circle Reserve Fund, managed by Blackrock, indicates that the existing holdings will reach maturity by May 31 at the latest.

Circle Reserve Fund Holdings. Source: cointelegraph

Just a few days ago, Treasury Secretary Janet Yellen mentioned that if Congress fails to raise the federal debt limit, the government will be compelled to make necessary “decisions.”

There is a disagreement between U.S. President Joe Biden and Republicans regarding the increase of the borrowing limit, currently at $31.4 trillion. If the country were to default on its debts, it would cause significant disruption to the $24 trillion Treasury market and the global financial system.

Tether, a competing issuer of stablecoins, asserts that a significant portion of its reserves is invested in Treasury Bills that typically mature in less than 90 days on average.

According to a quarterly assurance report released on May 10, the company mentioned that it has been actively taking measures to decrease its dependence on relying solely on bank deposits for liquidity.

Over the past year, the supply of USDC has been decreasing, dropping by 46% from its peak of $56 billion in June 2022. As a result, its market share has fallen to 23%, with a current circulation of $30 billion. In contrast, rival stablecoin Tether has experienced a surge in market dominance, now standing at 62%, with a circulation of $82 billion USDT.

During the month of April, Allaire attributed the decline in market capitalization of cryptocurrencies to the ongoing regulatory challenges faced by the crypto industry in the United States, as well as the imminent banking crisis.