In a surprising turn of events, the price of Curve DAO (CRV) recently crashed by nearly 30%, causing a wave of bearish sentiment across the crypto industry. The token dropped from $0.35 to a low of $0.27 due to massive liquidations.

Curve Finance’s founder, Michael Egorov, is facing the liquidation of millions of CRV tokens on various DeFi platforms. This follows Arkham’s report of a potential $140 million CRV liquidation. On-chain data suggests that the recent price crash has led to significant liquidations for Egorov.

Curve DAO Faces Major Liquidation Challenges

In a post on June 12, Arkham highlighted a looming $140 million in CRV liquidations. Aligning with this, Curve founder Michael Egorov has borrowed $95.7 million in stablecoins, mostly crvUSD, against his $141 million CRV across five accounts on five protocols. To maintain his positions, Egorov appears to be paying $60 million annually on Llamalend, as revealed by Arkham.

Data from PeckshieldAlert showed that a Michael Egorov-labeled address was already liquidated 20.2 million CRV on UwU Lend, another DeFi protocol, by the liquidator ‘sifuvision.eth.’ Amid the CRV price crash of almost 30%, a whale address 0xF078…0f19E was also recorded as being liquidated for 29.6 million CRV. Additionally, Lookonchain’s insights highlighted a trader’s liquidation of 10.58 million CRV on Fraxlend during the price crash.

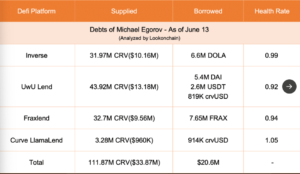

Meanwhile, Lookonchain’s data indicated that Egorov held 111.87 million CRV in collateral and $20.6 million in debt across four DeFi platforms: UwU Lend, Fraxlend, Curve LlamaLend, and Inverse.

Lookonchain-data-on-Curve-Finance-founder

CRV Token Faces Major Plunge Amid Market Turmoil

At the time of writing, the CRV token witnessed a massive plunge of 20.39%, reaching $0.2778. The token’s 24-hour lows and highs are $0.2236 and $0.3742, respectively.

Amid this panic-inducing scenario, CryptoQuant CEO Ki Young Ju highlighted a significant increase in CRV balance on exchanges on the microblogging platform X. The exchange balance hit an all-time high, spiking 57% in the later hours of June 13. This increase in exchange supply adds to the token’s downside pressure in the market.

CRV-Exchange-Balance Status by CryptoQuant

Despite these negative factors, data from Coinglass showed a 108.32% increase in the token’s Futures Open Interest (OI) to $105.65 million, along with a derivatives volume surge of 472.96% to $1.33 billion. This underscores growing investor interest in the asset despite the current market challenges.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News