While Chainlink (LINK) had a strong performance in September, its recent decline is prompting concerns about the sustainability of its bullish trend.

Chainlink (LINK) has experienced a substantial price increase of over 25% since September, surpassing the performance of Bitcoin (BTC), Ethereum (ETH), and many other cryptocurrencies. The project is currently the leading decentralized blockchain oracle solution and holds the 15th position in terms of market capitalization, excluding stablecoins.

During September, LINK’s price demonstrated an impressive surge of 35.5%. However, in the month of October, there has been a 10% correction in LINK’s performance. Investors are expressing concerns that a breach of the $7.20 support level might trigger further downward pressure, potentially erasing the gains achieved in the previous month.

Chainlink (LINK) 12-hour price index, USD. Source: TradingView

On September 30, LINK reached a closing price of $8.21, representing the highest level in over 10 weeks. However, when considering the broader context, Chainlink’s price remains significantly below its all-time high in May 2021, with an 86% difference. Over the past year, LINK has exhibited minimal growth, in stark contrast to Ether (ETH), which has seen a 21.5% increase in the same period.

The LINK community had high expectations for the SWIFT experiment

The LINK bull run kicked off following a significant report by SWIFT, a leader in international financial transaction messaging. Their report, released on September 31, emphasized the potential of connecting existing systems to blockchains, favoring this approach over the unification of various central bank digital currencies (CBDC). Through successful tests, SWIFT demonstrated its ability to offer a single access point to multiple networks using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This solution promised to reduce operational costs and challenges for institutions dealing with tokenized assets.

Furthermore, Chainlink’s value surge can be linked to the positive outcomes of tests involving their Australian dollar stablecoin by the Australia and New Zealand Banking Group (ANZ), which utilized Chainlink’s CCIP. ANZ deemed this transaction a “milestone” and saw the potential for real-world asset tokenization, possibly transforming the banking industry.

Another boost for Chainlink came on September 21, with the mainnet launch of the CCIP protocol on the Ethereum layer-2 platform Arbitrum One. This development aimed to facilitate cross-chain decentralized application development, providing access to Arbitrum’s efficient, low-cost scaling solution. Notably, other prominent Ethereum scaling technology companies had previously integrated Chainlink’s oracle services, including StarkWare.

Chainlink’s Multisig Changes and Reduced Protocol Fees Impact Investor Interest

In September, Chainlink faced criticism on social media for reducing security measures on its multi-signature wallet. Chainlink responded, explaining the change as part of a routine rotation. However, some analysts still expressed concerns about potential risks if signers went rogue. Despite these concerns, Chainlink’s protocol revenue has been declining for the past four months when measured in LINK terms.

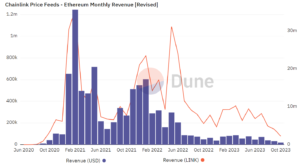

Chainlink price feeds revenue on Ethereum. Source: Dune Analytics & @ericwallach

In September, Chainlink’s price feeds generated 142,216 LINK in fees, equivalent to $920,455, which marks a 57% decrease compared to May. Some of this decline can be attributed to the drop in Ethereum’s total value locked (TVL), falling from $28 billion in May to the current $20 billion, a 29% decrease. However, this decrease doesn’t account for the entire difference, leading some investors to question Chainlink’s revenue model sustainability.

It’s essential to understand that Chainlink offers various services beyond just generating price feeds, operating on multiple chains, including CCIP. Nevertheless, Ethereum’s oracle pricing services remain a core part of the protocol’s business.

For comparison, Uniswap, the leading decentralized exchange, has a market capitalization of $2.38 billion, 42% lower than Chainlink’s. Uniswap also boasts $3 billion in total value locked (TVL) and generated $22.8 million in fees in September alone, according to DefiLlama.

Given these factors, investors have valid reasons to question whether LINK can maintain its $7.20 support level and sustain its $4.1 billion market capitalization.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News