Despite Dogecoin’s price increase, market sentiment remained negative, and indicators suggested a bearish outlook for the meme coin.

Over the past week, Dogecoin’s price rose significantly, with CoinMarketCap reporting a more than 65% increase. Currently, DOGE is trading at $0.1414, with a market capitalization exceeding $20 billion.

DOGE Price Analysis: Exploring Potential Targets

On March 2nd, analyst World of Charts predicted a potential 135% surge in DOGE’s price, setting its next target at $0.265.

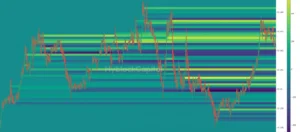

According to our analysis, DOGE encountered strong resistance around the $0.143 mark. A breakout above this level could trigger a further bullish rally.

Source: Hyblock Capital

Our examination of Santiment’s data indicated a considerable increase in Dogecoin’s Social Volume and MVRV Ratio, suggesting an elevated chance of a sustained price increase.

Additionally, the Binance Funding Rate for DOGE remained in the green, indicating active buying by derivatives investors at the time of assessment.

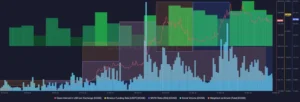

Despite the overall price increase, a few metrics presented a bearish outlook. Notably, DOGE’s Weighted Sentiment dropped, indicating an increase in negative sentiment surrounding the coin.

Bearish Signals for DOGE: Analyzing Metrics

Another bearish metric observed recently is the drop in Open Interest for DOGE.

Source: Santiment

Furthermore, at the time of assessment, the meme coin’s price had reached the upper limit of the Bollinger Bands, while its Relative Strength Index (RSI) indicated an overbought condition.

Source: TradingView

These indicators suggest that selling pressure may increase in the coming days, potentially signaling the end of DOGE’s bullish trend.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News