With Bitcoin’s price climbing above $65,000, many investors think the worst is over. The MVRV ratio, which measures profit against market value, suggests a buying opportunity with potential gains of 67%.

Bitcoin bounced back strongly last weekend, hitting $66,000 after a bit of selling last week. Now, analysts are keeping a close eye on where the price might go next. But there’s a catch: a lot of Bitcoin owners are already in profit, which could slow down further price increases.

Bitcoin Profitability Declines

Recent on-chain data reveals that 88.8% of Bitcoin holders are currently making a profit. Despite remaining high, this percentage has dropped noticeably from its peak earlier this year. On February 7th, 2024, Bitcoin reached a similar level of profitability when its price was $44,000.

Experts are now closely monitoring whether Bitcoin can maintain its current momentum or if a cooling-off period is needed for the market.

The % of the Bitcoin Supply in Profit is now at 88.8%

This is still elevated but has cooled down since the highs of earlier this year

The last time at this level was February 7th, 2024, when the price was $44K

Let's see if BTC has legs here or if it needs a further cool down pic.twitter.com/ZOBSU9RdDj

— On-Chain College (@OnChainCollege) April 21, 2024

Bitcoin Market Analysis: Signs of a Bottom and Buying Opportunities

Some market analysts, like Nebraskagooner, speculate that if Bitcoin climbs to $75,000 from its current level, it could signal that the market has hit its lowest point. Conversely, a drop below $58,000 suggests that the bottom hasn’t been reached yet.

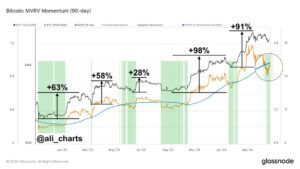

Moreover, the Bitcoin MVRV ratio, a metric used to assess market conditions, indicates a prime time to buy. Crypto analyst Ali Martinez points out that whenever the Bitcoin MVRV Ratio falls below its 90-day average since November 2022, it presents a favorable buying opportunity, historically resulting in an average gain of 67%. This trend has resurfaced, suggesting that now might be an optimal moment to invest in Bitcoin.

Martinez also highlights a significant shift in Bitcoin’s correlation with the Global Liquidity Index. While previously strong, the correlation broke in 2024. Martinez underscores the need for a liquidity boost before the US elections to sustain the ongoing Bitcoin bull market.

Courtesy: Ali Martinez

Despite Bitcoin miners experiencing a spike in fees, with 1,258 BTC paid in fees, the creation of new BTC addresses has slowed down, totaling only 260,838. This recent surge in transaction fees is largely attributed to the Runes protocol.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News