Bitcoin’s price remained above $28,000 after a bounce back to $30,000. This recovery was driven by false news about the approval of a spot Bitcoin ETF.

Bitcoin’s price is still in the positive territory several days after rumors circulated about the SEC approving a Bitcoin spot exchange-traded fund (ETF) proposal by BlackRock, which pushed the digital currency up to $30,000.

Although the brief surge in price following the false news revealed the importance of a Bitcoin spot ETF for the next bull run, Bitcoin’s price retraced from $30,000. However, bulls have managed to maintain support at $28,000.

Currently, Bitcoin is trading at $28,440 with substantial trading volume of $10 billion and a market capitalization of $555 billion, and it has remained relatively stable over the past 24 hours.

Could BlackRock’s Spot ETF Approval Send BTC to $42k?

All eyes are on the possible approval of the first Bitcoin spot ETF by the SEC in the U.S., especially after the agency gave the green light to several Ethereum futures ETFs earlier this month. A Bitcoin spot ETF is significant because it would allow both regular retail and institutional investors to get exposure to Bitcoin without the need to hold the actual cryptocurrency.

In simpler terms, investors wouldn’t have to deal with the complexities of crypto exchanges or wallet setups. They could easily get exposure by buying shares of a Bitcoin ETF through a regular brokerage account. This accessibility is why the approval of a Bitcoin spot ETF would be a game changer for the crypto industry.

A recent report by Matrixport suggests that if the SEC approves BlackRock’s proposal, Bitcoin’s price could see a substantial increase to $42,000. Chinese crypto journalist Wu Blockchain even mentioned an optimistic estimate of Bitcoin reaching $56,000 with an influx of $50 billion.

The Matrixport report is based on a survey of around 15,000 U.S. registered investor advisors overseeing approximately $5 trillion. The report suggests that if Tether’s market cap increases by $24 billion, serving as an indicator of potential ETF inflows, Bitcoin could rise to $42,000 as a conservative estimate. With a larger influx of $50 billion (equivalent to a 1% allocation from RIAs), Bitcoin could potentially rally to $56,000.

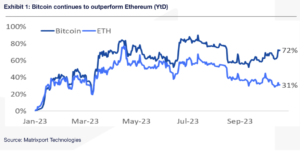

Bitcoin vs Ethereum performance | Matrixport

Bitcoin Price Targets Short-Term Breakout to $30,000

Bitcoin’s price is currently under the control of bullish sentiment, supported by the Moving Average Convergence Divergence (MACD) indicator signaling a buy on the daily chart. Moreover, the price is comfortably above several key moving averages, including the 21-day Exponential Moving Average (red), the 100-day EMA (blue), and the 200-day EMA (purple).

BTC/USD daily chart | Tradingview

If the bulls maintain their support at $28,000, this could encourage more retail traders to invest in Bitcoin, as they become less apprehensive about potential losses, thanks to the optimistic outlook for gains beyond $30,000.

At this point, a break above $30,000 suggests that Bitcoin might retest its 2023 high of $31,860. This level will be crucial in determining whether the bulls can push the price towards $42,000 or if it will remain within the range, with primary support around $25,000.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News