- The market capitalization of Pepe (PEPE) has surged impressively and is approaching the $1 billion mark.

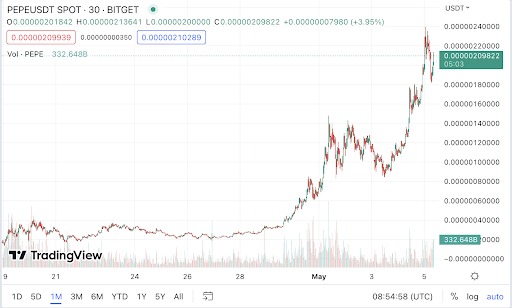

- In the past 24 hours, the value of the meme-inspired cryptocurrency, Pepe, has surged by 78%, and its trading volume has exceeded $859 million.

- Experts speculate that the release of Pepe on the Binance exchange is imminent, as Binance has announced the “PEPE Buying Guide.”

Pepe, a cryptocurrency associated with the internet meme character Pepe the Frog, has emerged as a significant player in the meme coin industry, competing against popular coins such as Shiba Inu (SHIB) and Doge (DOGE).

Pepe’s surge in market capitalization and trading volume is attributed to its recent listing on BitMEX, a major player in the cryptocurrency exchange industry. Users can now trade Pepe against the US dollar and Tether with up to 50x leverage on BitMEX.

Pepe’s trading volume in the past 24 hours has exceeded that of the well-known Dogecoin (DOGE), indicating its increasing popularity. As a result, early investors are now making profits.

PEPE is currently being traded for $0.00000209 per unit on the OKX exchange, with a trading volume of $318 million in the past 24 hours, specifically for the PEPE/USDT pair.

Image source “Trading View”

PEPE Bullish or Bearish?

Investors have been buying Pepe coin steadily in the past week, causing it to rise in popularity. According to CoinMarketCap, the meme coin has provided its initial investors with a remarkable 2790% return on investment since its launch.

Since OKX listed a PEPE/USDT pair on May 1, it has quickly become the top exchange for PEPE trading volume. Additionally, Binance has released a guide on how to buy PEPE, leading some Twitter users to speculate that a listing on the world’s largest exchange may be imminent.

Pepe, the meme-inspired cryptocurrency, has entered the top 100 cryptocurrencies list on May 3. Some experts think that this might be a sign that the coin’s value has risen too quickly and that it may be in a bubble.