Robinhood, the trading platform, is currently in the process of settling a lawsuit with investors who sued over its decision to halt trades involving meme stocks like GameStop in early 2021.

According to a filing submitted to the Miami federal court on May 28, Robinhood’s legal team mentioned that they are nearing the completion of the settlement negotiations with the investor group. They anticipate reaching an agreement and obtaining a dismissal of the case within the next two weeks.

Robinhood Settles Lawsuit Over Meme Stock Trading Halt

Robinhood, a popular trading platform, is nearing a settlement with investors who filed a lawsuit regarding its decision to halt trades involving meme stocks such as GameStop in early 2021. The filing submitted to the Miami federal court on May 28 indicated that Robinhood’s legal team expects to finalize the settlement with the investor group within the next two weeks. Details of the settlement were not disclosed, and representatives from Robinhood and the investor group have yet to comment on the matter.

The lawsuit, led by Lead Plaintiff Blue Laine-Beveridge, alleges that Robinhood engaged in illegal market manipulation and caused significant financial losses by restricting trades on certain stocks between January 28 and February 4, 2021. Stocks affected included GameStop, AMC, Bed Bath & Beyond, BlackBerry, Nokia, trivago, Koss, Express Inc., and Tootsie Roll, among others.

The investors’ legal action focuses on Robinhood’s alleged violations of securities laws and is part of a broader set of cases across different U.S. jurisdictions related to the platform’s handling of meme stocks.

The settlement follows U.S. District Judge Cecilia Altonaga’s denial of the investors’ motion for class certification on April 19. Judge Altonaga had previously rejected a similar request in November of the previous year.

GameStop and AMC Stocks: Meme Stock Phenomenon

GameStop and AMC stocks have gained notoriety as meme stocks, driven by individual investors who trade them based on social media buzz rather than traditional metrics. In January 2021, GameStop experienced a dramatic surge fueled by a short squeeze, where hedge funds and short sellers incurred substantial losses while retail investors saw significant gains.

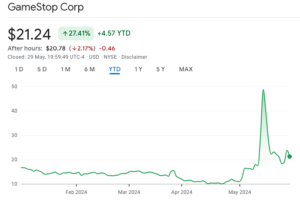

Keith Gill, known as Roaring Kitty, is credited with influencing this movement through his online presence and analysis. His recent return to posting cryptic memes on social media in May rekindled investor enthusiasm, contributing to GameStop’s price increase. On May 14, GameStop reached its highest level since then, closing at $48.75.

However, GameStop’s stock price has since retreated. By May 29, it fell by over half to close at $21.24, representing an 11% decline. After hours, the price dropped further to $20.78.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News