SEC Commissioners Hester Peirce and Mark Uyeda have made a bold move by using satire to express their disagreement with the recent ShapeShift settlement. They highlighted the difficulties crypto firms encounter with regulations.

By humorously mocking the SEC’s “come in and register” message, they revealed the confusion and uncertainty within the crypto regulatory environment.

ShapeShift Case: Debate, Operations, and Satirical Dissent

The recent ShapeShift case, in which the Swiss company faced charges of acting as an unregistered dealer, has triggered a contentious discussion about the SEC’s regulatory approach to cryptocurrencies. As part of the settlement, ShapeShift agreed to pay a $275,000 penalty.

The SEC’s order revealed that ShapeShift operated ShapeShift.io, an online platform facilitating the buying and selling of digital assets from 2014 to early 2021. By acting as a counterparty to each transaction, the company positioned itself as a crypto “vending machine.” However, the SEC’s charges raised questions about whether certain crypto assets should be classified as securities, subject to strict regulatory oversight.

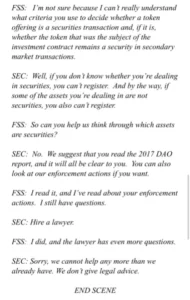

SEC Commissioners Peirce and Uyeda’s hypothetical dialogue. Source: Eleanor Terret on X

Commissioners Peirce and Uyeda’s satirical dialogue, reported by Fox Journalist Eleanor Terret, sheds light on the regulatory uncertainty faced by companies like ShapeShift. The conversation between “Future ShapeShift” and the SEC illustrates the challenges of determining which assets should be registered as “securities,” emphasizing the lack of clear criteria and the complexities of the regulatory environment.

Challenges of Regulatory Clarity in the Crypto Space

Critique of the “Come In and Register” Campaign: The dissent from Peirce and Uyeda serves as a pointed criticism of the SEC’s “come in and register” initiative, which they argue lacks clear guidance for crypto companies. The satirical dialogue highlights concerns about the potential stifling effect on innovation, as entrepreneurs may fear future enforcement actions.

Balancing Innovation and Investor Protection: As the crypto industry expands, regulators face the challenge of balancing innovation with investor protection. The ShapeShift case and the commissioners’ dissent emphasize the pressing need for regulatory clarity and comprehensive guidance in the digital asset ecosystem.

The daily chart shows the total crypto market cap’s uptrend. Source: TOTAL on TradingView.com

Market Growth Amidst Uncertainty: Despite regulatory uncertainties, the cryptocurrency market continues to grow rapidly. With a total market capitalization of $2.44 trillion and a 5% increase in the past 24 hours alone, cryptocurrencies are experiencing significant growth. Bitcoin, the leading cryptocurrency, reached a new all-time high of $69,300 on Tuesday.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News

Author

-

Asad is a dynamic and talented cryptocurrency content author who brings a wealth of knowledge and enthusiasm to every article. With a deep understanding of blockchain technology and a passion for digital assets, Asad's writing is both informative and engaging.

View all posts