Chainlink has seen widespread accumulation, with minimal selling pressure. Despite this, bulls have yet to signal a breakout, leaving the market in a balanced state, anticipating decisive moves from both sides.

Over the last two months, Chainlink (LINK) has been trading within a set range, fluctuating between $13.3 and $16.6. Notably, the upper limits of this range have proven to be a challenging hurdle for any significant breakthrough. Despite this, optimistic investors among the bulls can reasonably anticipate a potential move for LINK to reach the $20 mark.

LINK’s Support and Resistance Dynamics: Potential for a Rally?

According to a recent analysis by Ali on X, the $14.8-$15.2 range has proven to be a robust demand zone for Chainlink (LINK). Notably, 85.13 million LINK tokens were purchased within this zone, indicating strong buyer interest.

#Chainlink has built a solid demand zone between $14.8 and $15.2, where 17,650 addresses bought 85.12 million $LINK. With the lack of resistance ahead, #LINK could be positioned to advance toward $20. pic.twitter.com/jJwfVbM4eE

— Ali (@ali_charts) January 15, 2024

Ali also observed that the resistance levels above were relatively weak. Despite this, a key consideration arises — with a significant proportion of holders currently in profit, does another LINK rally seem plausible?

Santiment’s data analysis reveals a network-wide accumulation of LINK, with the mean coin age metric steadily increasing since December 15th. This suggests a trend of holding LINK rather than selling.

Market Sentiment and Dormant Circulation

Interestingly, the weighted market sentiment has shifted from positive to negative, diverging from the bullish trend seen in September. Meanwhile, dormant circulation has experienced notable spikes in the past two weeks, pointing to reduced selling pressure and an inclination among investors to retain their LINK holdings.

Source: Santiment

In conclusion, the confluence of a sturdy demand zone, weak overhead resistance, ongoing network-wide accumulation, and favorable dormant circulation trends raises the question of whether another LINK rally is on the horizon.

LINK: Accumulation Signals and Rally Potential

Since mid-November, the MVRV ratio for Chainlink (LINK) has been on a downward trajectory and currently hovers just above zero at present. This decline indicates that the token is not overvalued. When coupled with the observed accumulation trend, it suggests that LINK may have the potential for a forthcoming rally.

A closer examination of supply distribution reveals notable dynamics among different holder categories. Whales, defined as addresses with 1 million or more LINK, experienced a surge in holdings on December 7th, coinciding with a decrease in the 10-1 million LINK holder count.

Source: Santiment

This shift implies profit-taking by some holders within this bracket. Interestingly, even before this event, these addresses had been trending lower, indicating prior selling activity. Post-December 7th, their holdings increased proportionally, signifying a renewed phase of accumulation.

In contrast, addresses holding 0-10 LINK steadily increased, showcasing a consistent accumulation trend irrespective of price movements. However, a minor concern arises as whale holdings have seen a slight decrease over the past month. Despite this, the overall narrative favors accumulation, reinforcing the potential for a LINK rally in the future.

LINK Technical Analysis: Crucial Range and Market Dynamics

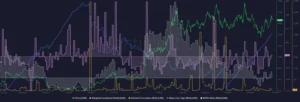

In the technical analysis of Chainlink (LINK), the midpoint of the purple range is identified at $15, serving as a crucial level of importance on higher timeframes. Over the past two months, this point has played a dual role, functioning as both support and resistance.

Source: LINK/USDT on TradingView

The market structure has exhibited a transition from bearish to bullish, influenced by the range-bound price action. On the one-day chart, the Relative Strength Index (RSI) registers at 53, indicating a state of neutrality. Simultaneously, the On-Balance Volume (OBV) remains confined within a range, showcasing an equilibrium between buyers and sellers in the spot market.

With the RSI at a neutral 53 and the OBV exhibiting range-bound behavior, buyers and sellers in the spot market appear evenly poised. This equilibrium is further emphasized by the substantial amount of LINK bought in the $14.8-$15.2 window. This accumulation suggests that bulls would vigorously defend against any attempts by sellers to drive prices lower.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News