The crypto market is booming, with Bitcoin bouncing back to over $62,000 after dropping to $49,000 earlier this week. It’s currently at $61,343.58, up 7.27% in the past 24 hours, and its dominance has increased to 56.42%. Meanwhile, Ethereum has risen 11.03% to $2,698.41, with a market cap of $324.75 billion, up 10.38% from yesterday.

Bitcoin’s recovery has sparked a significant rally in altcoins, boosting the total market cap of all cryptocurrencies to over $2.15 trillion. Notable performers like Sui, Helium, Celestia, Pepe, JasmyCoin (JASMY), Hedera Hashgraph (HBAR), and Brett have all risen by more than 30% from their lowest prices this month.

Bitcoin’s Bullish Signs: Hammer Pattern, Wedge, and EMA

Bitcoin’s recent price movement shows several bullish signs. First, the coin formed a hammer candlestick pattern, a well-known reversal signal that appears during a downtrend. This pattern features a long lower shadow and a small body, suggesting a potential reversal in the market.

Second, Bitcoin has created a falling broadening wedge pattern. This pattern is characterized by an upper trendline connecting lower highs and a lower trendline connecting lower lows. Typically, this formation leads to a strong bullish breakout, especially when supported by increasing volume. Recent data shows that Bitcoin’s trading volume has been rising gradually.

Source: X

Third, Bitcoin has successfully avoided a death cross by rising above the 200-day Exponential Moving Average (EMA). A death cross, which occurs when a short-term moving average crosses below a long-term moving average, often signals further declines. By surpassing the 200-day EMA, Bitcoin has mitigated this bearish signal, reducing the risk of further downward pressure on its price and other altcoins.

Bitcoin price | Chart by TradingView

Altcoin Rally Linked to Economic Concerns and Fed Rate Cuts

The rise in altcoin prices is partly due to increasing fears of a US recession or a mild economic slowdown. Recent economic data reveals troubling signs, such as a rise in the unemployment rate to 4.3% and declining wages. Persistent unemployment often signals an impending recession, and the yield curve has recently begun to de-invert after being inverted for years, suggesting economic trouble ahead.

While recessions typically negatively impact stocks, cryptocurrencies, and other assets, history shows that these assets can perform well during such times. This is often because central banks, like the Federal Reserve, respond to recessions by cutting interest rates. Economists expect the Fed to start cutting rates in September, with some predicting up to 100 basis points (bps) by December, and others forecasting a 125bps reduction. ING notes that a 50bps cut in September followed by gradual reductions is likely, aiming for a Fed funds rate of around 3% by next summer.

Bitcoin and other altcoins tend to benefit from such rate cuts, as seen during the Covid-19 pandemic. With over $6.1 trillion invested in low-risk money market funds, the anticipated rate cuts could lead to some of these funds shifting into cryptocurrencies.

This economic environment has also contributed to rebounds in traditional stocks. The Dow Jones Industrial Average increased by over 680 points, while the Nasdaq 100 index rose by 465 points. In Asia, the Nifty 50 and BSE Sensex both gained over 1%, and the Nikkei climbed by 1%.

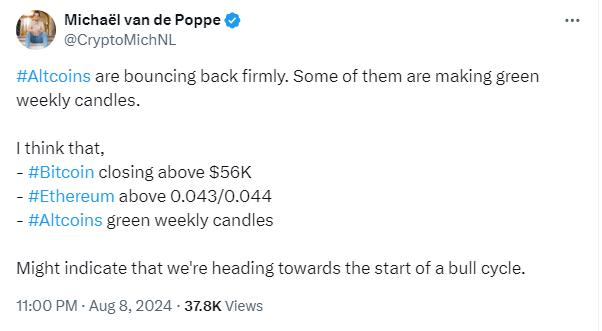

Source: X

Altcoin Rally and the Risk of a Dead Cat Bounce

The recent rise in altcoins like Hedera, Brett, Jasmy, and Pepe might be attributed to a “dead cat bounce.” In technical analysis, a dead cat bounce refers to a brief recovery in an asset’s price after a significant drop, followed by a continuation of the downward trend.

This phenomenon can act as a bear trap, where investors buying the dip end up facing significant losses when the price reverses downward. Dead cat bounces often last only a few days or weeks before the asset resumes its decline.

In this context, the rally will be considered a dead cat bounce if the price fails to break through the key resistance level at $72,000, which it struggled to surpass in July. If this bounce is indeed a dead cat bounce, these altcoins could experience a sharp reversal in the near future.

Altcoin Rally Driven by Fear and Greed Index and Regulatory News

The rise in tokens like Hedera, Brett, Jasmy, and Pepe can be attributed to changes in the fear and greed index. The index has shifted from a fear level of 35 to a neutral point of 56, with indications that it might soon move into the greed zone at 60. Cryptocurrencies typically perform well when market sentiment leans toward greed.

Additionally, regulatory developments are contributing to the rally. On Wednesday, Ripple Labs received a significant reprieve in the US when a judge ordered the company to pay $125 million. Although this sum is substantial, it is much smaller compared to the $2 billion the Securities and Exchange Commission (SEC) was originally seeking.

Recent Price Movements in Cryptocurrencies

Solana (SOL) experienced a 2.78% increase in its price, reaching $158.36 today. The coin’s 24-hour low and high were $151.74 and $163.18, respectively.

In contrast, XRP saw a slight decline of 0.51% over the past day, settling at $0.6123. Its 24-hour low and high were $0.5962 and $0.6416, respectively.

The meme coin sector saw notable gains. Dogecoin (DOGE) rose by 5.38%, reaching $0.1055, while Shiba Inu increased by 5.01%, trading at $0.0000141. Additionally, PEPE, WIF, and FLOKI saw price surges between 2% and 11%.

Crypto Market Winners and Losers

Crypto Gainers Today

- Sui (SUI): Price soared by 30.16% to $0.8394.

- Celestia (TIA): Price surged 18.87% to $5.68.

- Helium (HNT): Price gained 17.99% to $5.88.

- Bittensor (TAO): Price rallied 16.63% to $311.93.

Crypto Losers Today

- Aave (AAVE): Price dipped 4.04% to $99.29.

- MANTRA (OM): Price fell 1.51% to $0.9988.

- Stellar (XLM): Price tumbled 1.36% to $0.1021.

- Akash Network (AKT): Price saw a slight decline of 0.34% to $2.62.

Despite these movements, hourly charts for Bitcoin (BTC) and Ethereum (ETH) show a slight decline of 0.58% and 0.56%, respectively, indicating potential volatility in crypto prices throughout the day.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News

Join our official TG Channel: https://t.me/CryptosHeadlines