The upcoming Bitcoin halving, which will slash the supply by 50%, is poised to be a powerful catalyst for the Bitcoin price. Analysts are conservatively predicting a significant rally in Bitcoin’s value, with expectations set at $273,000.

Recently, the price of Bitcoin (BTC) has been under some selling pressure, but the balance between demand and supply is strongly favoring Bitcoin. Moreover, the situation is expected to become even more intriguing in the next two months. This anticipation stems from another 50% reduction in supply following the upcoming Bitcoin halving event.

Analyst Willy Woo’s Highlights: Bitcoin’s Demand-Supply Gap

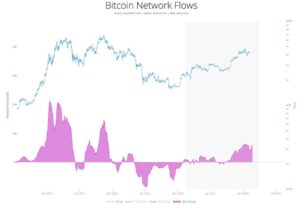

Renowned crypto analyst Willy Woo has drawn attention to a substantial gap between the burgeoning demand from new investors and the relatively limited fresh supply within the Bitcoin network.

Woo’s analysis reveals a remarkable influx of approximately $607 million per day in new investor demand into the Bitcoin network. This is contrasted with a more modest $46 million per day in new supply originating from freshly mined coins.

Courtesy: Willy Woo

With the Bitcoin halving, which will further reduce the rate of new supply, just 60 days away, Woo underscores the significance of this impending event. He gauges new demand by monitoring changes in realized capitalization, which reflects the cumulative price paid by investors for their BTC holdings. However, it’s important to note that this method might underestimate actual demand, as it does not factor in off-chain buy/sell activities.

Bitcoin’s Price Potential: A Simplified Analysis

With the supply of Bitcoin going down and demand on the rise, it’s creating a strong force that could lift BTC prices significantly. MacronautBTC, commenting on Willy Woo’s tweet, has a fascinating take on how Bitcoin’s price might increase five times its current value, playing it safe.

MacronautBTC’s study zooms in on what happens after the halving event, imagining a situation where the daily demand for Bitcoin (around $607 million post-halving) exceeds the daily new supply by $23 million. If this continues over 250 trading days in a year, MacronautBTC estimates an extra market value of $1.46 trillion.

Hows my arithmetic:

Assume from halving:

$607M daily demand minus $23M daily new supply =$584M daily demand * 250 trading days in a year = $1.46T new ADD'L mkt cap.

~every 1T in market cap is $50k in $BTC price, right? So that would be a new #bitcoin price of $123k.

(cont'd)

— MacronautBTC (@Macronaut_) February 23, 2024

Now, according to MacronautBTC’s math, each trillion added to the market corresponds to a $50,000 bump in Bitcoin’s price. Following this, the predicted extra market value of $1.46 trillion could potentially push Bitcoin’s price up to $123,000.

In addition, MacronautBTC brings up a “multiplier” idea from analyst Willy Woo. This multiplier hints at a potential threefold increase in Bitcoin’s value compared to the USD coming in. When combined with the expected extra market value, MacronautBTC dreams up a total market value of $5.38 trillion within a year, suggesting a jaw-dropping Bitcoin price surge to $273,000.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News