As the LINK price continues to rise, the activity on the Chainlink network has dropped significantly, down by 60% in the past week.

While Bitcoin remains steady around $34,200, altcoins like Solana (SOL), Cardano (ADA), and Chainlink (LINK) are still surging.

Chainlink (LINK) has surged 6.6% in the last 24 hours, approaching the $12 mark. In the past 10 days, LINK has gained about 45%, thanks to strong investor interest.

Can Chainlink Price Surge to $15?

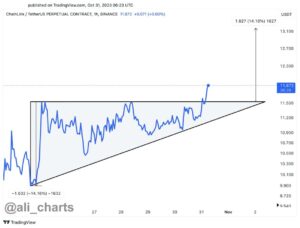

Crypto analyst Ali Martinez pointed out that Chainlink recently broke out of an ascending triangle pattern on its hourly chart. This bullish signal indicates a potential 14% price increase, with LINK potentially reaching $13.

Courtesy: Ali Martinez

The LINK price reached $11.50 today, accompanied by a significant 90% increase in 24-hour trading volume. However, potential investors should exercise caution because on-chain data reveals a decrease in trading activity.

Caution Indicated by On-chain Data

This chart from CryptoQuant shows Chainlink’s strong performance, reaching a 3-month high of 8,086 Active Addresses on October 23. Just a day after this milestone, the price of LINK jumped to $11.50, a level last seen in 2022.

However, in the week that followed October 23, the number of LINK’s Active Addresses significantly dropped to 3,233 by October 29. This represents a notable 60% decrease in daily network activity in just one week.

Courtesy: CryptoQuant

The Daily Active Addresses metric indicates how much existing users are using a blockchain network. A decrease in Active Addresses is usually seen as a bearish sign, suggesting that fewer people are using the project’s services.

As seen in the chart above, Chainlink’s network activity has decreased by a significant 60% over the past week.

Likewise, Santiment reports a notable drop in the creation of new addresses on the Chainlink network. The chart below shows that Chainlink Network Growth reached its highest point in 110 days, hitting 2,465 on October 23.

Courtesy: Santiment

In a similar fashion to the trend seen in Active Addresses, Network Growth data has also dropped significantly, falling by 60% to 1,008 new addresses as of October 29.

Network Growth is a metric that shows how fast new users are joining a blockchain ecosystem by monitoring the daily creation of new wallets. Usually, a decrease in Network Growth can negatively affect the prices of the ecosystem’s native token.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News