Solana’s price has dropped by 21% within a week. Despite this, data from both on-chain activities and derivatives markets suggests that investors remain confident in the network’s ability to overcome recent challenges.

Solana’s native token, SOL, priced at $135, saw a significant 21% drop last week, hitting its lowest point in nearly six weeks. This resulted in $113 million in liquidations of leveraged long SOL futures contracts since April 11. Previous investor optimism, driven by SOL’s 61% price surge in March, is now in doubt, prompting concerns about potential additional corrections and the strength of the $130 support level.

Solana’s Market Analysis and Ecosystem Expansion

Market analysts are scrutinizing Solana’s current market capitalization of $60 billion, considering it potentially inflated compared to Avalanche (AVAX) at $13 billion and Tron (TRX) at $10 billion, standing four and six times higher, respectively. However, proponents argue that Solana’s premium is justified by its rapidly expanding ecosystem, marked by numerous projects launching their own tokens.

Coinbase Integration Boosts Accessibility: On April 16, Coinbase announced full integration of its wallet with the Solana decentralized exchange (DEX) ecosystem, supporting over 50,000 Solana SPL tokens. This integration simplifies trading by enabling users to input the contract address directly into the “swap flow,” thus lowering entry barriers into Solana’s ecosystem.

Decrease in SOL Futures Open Interest: Between April 12 and April 17, open interest in SOL futures decreased by 40% to $1.5 billion, indicating reduced demand for leverage. Analyzing the SOL futures funding rate can reveal whether this decline stems from diminished interest in long positions.

SOL perpetual futures 8-hour funding rate. Source: Coinglass

Funding Rate Insights: The SOL perpetual futures funding rate often indicates market sentiment. A positive rate suggests higher demand for leveraged long positions, while a negative rate implies a preference for shorts, betting on a price decrease. Since April 12, the funding rate for SOL futures has been negligible, indicating a balanced interest between long and short positions. This data offers some reassurance despite SOL’s 33% price drop in the last 16 days, poised to close below $136 for the first time since March 6.

Challenges and Setbacks in the Solana Ecosystem

The Solana network recently grappled with severe congestion issues, experiencing transaction failure rates of up to 75%. In response, developers initiated an upgrade aimed at mitigating these bottlenecks. However, these challenges prompted several projects to delay their token launches until the network issues are fully addressed.

Compounding the pressure on SOL’s performance were setbacks in various notable projects, including MarginFi. The resignation of MarginFi’s CEO, Edgar Pavlovsky, on April 10 led to $190 million in withdrawals. Furthermore, accusations from other Solana-based projects against MarginFi for failing to release credits to users deepened the controversy, highlighting the volatility and challenges within the Solana ecosystem.

Despite underlying factors, the downturn in Solana SPL tokens was evident across the board. In the decentralized finance (DeFi) sector, Jito (JTO) plummeted by 29% since April 12, while Raydium (RAY) and Jupiter (JUP) saw declines of 24% and 27%, respectively. Additionally, prominent Solana memecoins, including Dogwifhat (WIF), experienced a steep 32% drop over a six-day period.

Solana’s DApp Activity and Price Trends

Analysts view Solana’s decentralized application (DApp) activity as a reliable indicator of SOL’s price movements. The usage of DApps inherently drives demand for SOL, driven by network usage fees and participation in SPL token airdrops.

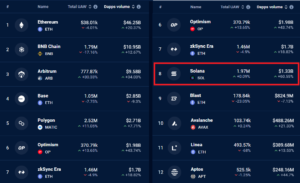

Top blockchains ranked by 7-day DApps volumes. Source: DappRadar

Recent data from DappRadar reveals a significant uptick in Solana’s DApp volumes, soaring by 60% to $1.3 billion over the past week, surpassing its competitors. During the same period, Ethereum experienced a 20% increase in activity, while BNB Chain saw a 13% rise. Despite these gains, Solana’s active user count remained stable at around 2 million, contrasting with Ethereum’s 4% drop in active addresses.

Given the stable demand for leverage in futures markets and robust on-chain activity, there’s little indication that SOL will lag behind the broader altcoin market. However, continued network congestion could pose a challenge to the sustainability of Solana’s premium valuation compared to other blockchain tokens.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News