Uncover the reasons behind the surge in Terra Classic price today and explore if this positive trend is expected to persist in the coming months.

Terra Classic’s price is rising, thanks to a series of positive announcements that align perfectly with Terra Labs’ revival plans. Luna Classic has been grabbing the crypto industry’s attention with consistent record-breaking price surges for more than a month.

Terra Luna Classic’s Remarkable Comeback: Factors Behind the Surge

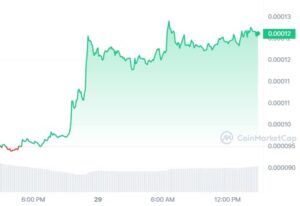

Currently hovering around $0.0001203, Terra Luna Classic (LUNC) has experienced a notable 25.16% surge in the last 24 hours, accompanied by a 25.17% increase in market capitalization, reaching over $698.4 million. Over the entire month of November, LUNC has witnessed a substantial 85% price increase, moving from $0.00006517 with four zeros to the current three zeros.

This article delves into the various factors contributing to the recent price surge of Terra Luna Classic and explores the elements sustaining this positive momentum. Additionally, we analyze the future prospects of the twin tokens, LUNC and USTC.

The Terra Luna ecosystem faced challenges in the crypto industry last year, enduring a crash after reaching its all-time high value in April. Following unexpected events, Terra founder Do Kwon opted for a hard fork, giving rise to Terra 2.0 and its cryptocurrency, LUNA. The original blockchain continued with its twin cryptos: Luna Classic (LUNC) and UST Classic (USTC).

Luna Classic witnessed a significant price decline, plummeting over 96% from its all-time high of $119 in April. This downturn resulted from the loss of the US dollar peg by the algorithmic stablecoin USTC. The interconnected nature of LUNC and USTC led to a cascading effect, causing the entire ecosystem to collapse.

Despite a brief recovery in September, Luna Classic followed a prolonged downward trend punctuated by occasional price spikes. Recently, a series of positive developments has propelled Luna Classic’s price upward, marking a significant resurgence in the cryptocurrency’s value.

Terra Luna Classic’s Rise and its Connection to Bitcoin

Over the past month, Terra Luna Classic’s price has seen a continuous upward trajectory, prompting both investors and crypto enthusiasts to seek reasons behind this positive trend. As more investors acquire LUNC tokens, there’s a growing curiosity about the duration of this upward movement. This discussion explores potential factors contributing to Luna Classic’s current price surge.

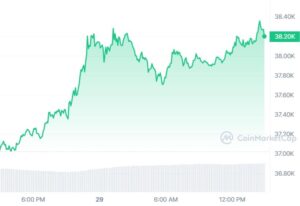

The ongoing surge in Terra Classic’s price is closely linked to the rally in Bitcoin’s price. Despite a more than 25% increase in LUNC and a 3.29% uptick in Bitcoin, the price charts for both cryptocurrencies are on an upward trajectory. Bitcoin has surpassed the $38,000 mark in the last 24 hours, a significant milestone not seen for around 18 months.

Bitcoin’s influence on the overall crypto market is undeniable, with its dominance at 52.01%. Luna Classic, along with the entire crypto market, tends to move in tandem with Bitcoin’s price movements. Therefore, a significant reason behind the surge in LUNC’s price is the ongoing rally in the price of Bitcoin.

USTC Price Surge in November 2023: Token Burning and Strategic Investments

In November 2023, the USTC price has witnessed a substantial increase, driven by multiple factors that unfolded in the preceding weeks. The upward trend began in late October 2023 and gained momentum through various events.

A pivotal moment in the rally occurred when both LUNC and USTC prices experienced a 15% and 12% surge, respectively, following the removal of 800 million USTC tokens through a token burning mechanism. This decision stemmed from a Terra Classic community vote to blacklist the Ozone protocol wallet, which held the mentioned USTC tokens.

The second significant price surge was sparked by a strategic investment in USTC by Terra Classic Labs. The USTC price soared by nearly 300%, escalating from around $0.1 to over $0.07. Trader QT, an official partner at Terra Classic Labs, announced on X that the purchase of 25.6 million USTC tokens by Terra Classic Labs played a pivotal role in driving up the USTC price. Given that USTC and LUNC share the same blockchain and community, the positive price sentiment also impacted Luna Classic, leading to an increase in LUNC’s price.

Mint Cash Emerges: Airdrop Sparks Buzz and Market Movement

In the realm of crypto projects, Mint Cash has emerged as a new player, drawing inspiration from Bitcoin and focusing on stable and permissionless payments. While sharing a similar vision with the Terra Luna Classic community, Mint Cash takes a different approach to realizing its goals. Notably, it positions itself as a spiritual successor to TerraUSD (USTC).

(1/n) while we can't reveal how airdrops for $LUNC / $USTC holders will be done in detail just yet, here is a high level overview.

to receive more airdrops, you must lock more $USTC with our airdrop contract deployed on Terra Classic.

— Shin Hyojin 신효진 🏛️♻️ (@shinhyojin1031) November 25, 2023

Shin Hyojin, the lead of the Mint Cash project, made waves with an announcement on X, revealing plans for an airdrop targeting USTC and LUNC token holders. What caught attention was the claim that the airdrop would release tokens with an evaluation of $1USTC = $1 USD.

This announcement stirred excitement within the Terra Classic community, leading to an increase in both USTC and LUNC prices. The interconnected nature of LUNC and USTC tokens played a role in the rise of LUNC prices in response to the surge in USTC.

Please be aware that Terraform Labs is not involved in Mint Cash in any capacityhttps://t.co/7hLOh6MaPY

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) November 27, 2023

However, Terra Money officially clarified that Terraform Labs has no affiliations with Mint Cash. Despite this revelation prompting a price dip for both USTC and LUNC, the LUNC price managed to recover after the initial setback.

Binance Launches USTC Perpetual Contracts: Impact on Terra Prices

In a significant move, Binance announced the introduction of USD-M USTC perpetual contracts, offering a substantial 50x leverage. This news emerged amidst the ongoing price rallies and growing positive sentiment among investors. Within a few hours of the announcement, both USTC and Luna Classic experienced remarkable surges, witnessing a 300% and 60% increase, respectively. Binance’s announcement further fueled the upward trajectory of Terra Classic’s prices.

As of November 2023, Terra Classic and USTC prices continue their upward momentum. The Terra community’s steadfast commitment to revitalizing the ecosystem has instilled confidence in investors, prompting them to remain engaged and supportive of the project.

The present upward movements in Terra Classic’s prices, including LUNC, indicate positive signals that could lead to further increases. The anticipation surrounding Bitcoin ETF approvals and the upcoming Bitcoin halving event holds the potential to propel BTC above $40k in the coming months. If Bitcoin’s price experiences improvement, it is likely to positively influence other cryptocurrencies, including Luna Classic.

While Luna Classic’s price movements can’t be solely predicted based on Bitcoin’s performance, the combination of overall crypto market dynamics with Terra Classic project developments and revival plans could pave the way for significant increases in LUNC’s price, reaching new heights.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News