In the last day, the decentralized exchange aggregator Jupiter saw a substantial trading volume of nearly $1.4 billion. This surge coincided with the launch of its own cryptocurrency token.

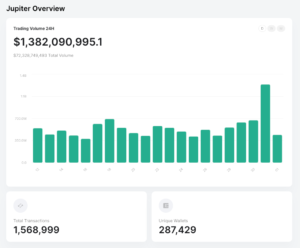

In the past 24 hours, Solana DEX aggregator Jupiter (JUP) facilitated an impressive $1.38 billion in trading volume, marking a significant increase compared to its recent daily trading volume. This surge solidifies Jupiter’s position as the top DEX platform during this period.

Jupiter Token Launch and Airdrop Spark Solana Network Surge

Yesterday marked the highly-anticipated launch of the Jupiter token and accompanying airdrop, igniting a surge in activity on the Solana network. Web3 wallet Phantom reported unprecedented levels of traffic, surpassing even the recent WEN meme token launch by threefold.

Jupiter daily trading volume. Image: Jupiter.

The governance token for Jupiter began trading at 10 a.m. ET, initially priced at $0.40 on the platform’s native liquidity pool, in alignment with the pool’s price curve. Major centralized exchanges like Bybit, Binance, Bitfinex, and OKX quickly followed suit, offering trading for the token.

As of now, JUP is trading at $0.60, marking a 50% increase from its initial trading price. This surge has propelled its market cap to $808 million, with a fully diluted value of $6 billion. At launch, 1.35 billion tokens, equivalent to 13.5% of the total 10 billion supply, were in circulation.

Simultaneously with the token launch, Jupiter initiated its initial token airdrop, targeting users who traded at least $1,000 on the platform before November 2. This retrospective airdrop aims to reach 955,000 wallet addresses, with 62.9% of JUP tokens already claimed across over 450,000 addresses, as per a Dune Analytics dashboard.

Over the course of four phases, the project intends to airdrop a total of four billion tokens, comprising 40% of Jupiter’s total supply, to users. Future airdrop rounds will also extend rewards to new users, according to Jupiter’s plans.

Controversy Surrounds Jupiter Token Launch

Amid the excitement of the Jupiter token launch, controversy arose as some users raised concerns about the token launch pool being utilized by the team to sell tokens to the public.

In response to these concerns, the project’s pseudonymous founder, Meow, emphasized transparency regarding the mechanics of the launch pool. Meow stated that the team had initially allocated a sales ratio of 20%, which was subsequently reduced to 5%, and then to 2.5% of the token supply. The founder further noted that the team could have pursued alternative fundraising methods, such as an initial DEX offering or over-the-counter sales, but opted for a more transparent approach.

Explaining the rationale behind this decision, Meow highlighted that by structuring the launch in this manner, airdrop recipients would have access to a significant pool for selling, while prospective buyers would be assured of a substantial pool capable of absorbing selling pressure from airdrops. This approach aimed to mitigate the risk of immediate significant losses for buyers.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News