Large Chainlink whales have been aggressively accumulating the cryptocurrency, acquiring 57 million LINK tokens valued at $855 million over the past month.

IntoTheBlock, a leading on-chain data provider, highlighted this notable statistic in a recent post on X. Despite market volatility and Chainlink’s retracement from gains achieved during the late 2023 rally, large whales continued their accumulation campaign, further solidifying their positions in the cryptocurrency.

Chainlink’s Large Holders Accumulation Amidst Price Volatility

Analyzing data from the Chainlink Large Holders Netflows chart provided by IntoTheBlock unveils an intriguing pattern closely tied to LINK’s price movements.

In the first two days of January, significant accumulation occurred among these addresses, with over 4 million LINK added to their balances daily. This influx coincided with LINK maintaining a price level around $15, benefiting from the bullish momentum carried over from the previous year.

However, on January 3rd, market turbulence struck, causing Chainlink’s price to dip below key psychological levels such as $15, $14, and $13. This downturn led to LINK plummeting to a low of $12.20, triggering a notable selloff trend. Large LINK whales joined the selling pressure, offloading over 2 million tokens during this period.

Despite the downward trend, these large whales continued to accumulate LINK assets over the following week. This accumulation persisted even as Chainlink struggled to reclaim the $15 price level, indicating a bullish sentiment among these significant holders amidst market uncertainty.

Chainlink’s Large Holders’ Extended Accumulation Period

The phase, akin to a “buy-the-dip” period, marked the largest consecutive days of sustained accumulation, with daily purchases exceeding 4 million LINK for five days.

This prolonged accumulation phase concluded as Chainlink retested $15 on Jan. 10 and dropped below the threshold two days later. Subsequently, these whales exhibited erratic purchase and selloff activities, although purchases predominantly outweighed sales.

According to data from the IntoTheBlock chart, the accumulation ceased on Jan. 24 and remained subdued until Jan. 29. Throughout the 30-day period, these whales amassed over $855 million worth of LINK, underscoring their confidence in the token’s long-term potential.

Chainlink’s Reduced Selling Pressure and Exchange Outflows

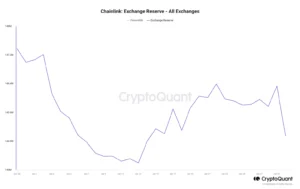

As Chainlink aims to surpass its December 2023 high above $17, selling pressure has notably diminished. Recent CryptoQuant data indicates a decline in LINK reserves on centralized exchanges since yesterday, reaching lows last observed earlier this month.

Chainlink Exchange Reserve | CryptoQuant

Additional data confirms the ongoing trend of investors transferring their LINK off exchanges, presumably for long-term holding. According to the Chainlink Exchange Netflows, over 1.392 million LINK was withdrawn from exchanges today.

Chainlink Exchange Netflow | CryptoQuant

This marks the largest intraday LINK withdrawal from centralized exchanges in over a year, as indicated by the chart data. Meanwhile, LINK has capitalized on this reduced selling pressure and the resurgence of Bitcoin to rally by 5% in the past 24 hours. At present, the asset is trading at $15.17.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News